The movement for school choice in Mississippi has momentum.

There is a growing chance that we will see a move to create a universal Education Savings Account for every child in Mississippi, similar perhaps to those in surrounding states such as Arkansas.

Fearful of this, ideologues opposed to parent power are starting to marshal dishonest arguments against school choice.

Some have started to suggest that creating Education Savings Accounts in our state would be somehow unconstitutional, citing a case currently before the state Supreme Court regarding the use of American Rescue Plan Act (ARPA) funds in support of this idea.

The argument that the constitution prevents Mississippi establishing a program of universal Education Savings Accounts is nonsense. Many of those making it must know it is a nonsense.

The danger is that those looking for a convenient excuse not to support education freedom in Mississippi will latch on to these bogus arguments.

“Of course, I personally support school choice” some will say. “But sadly, our constitution means that we just can’t have the type of system they have in Arkansas”.

To ensure that every lawmaker knows that there is no constitutional impediment to establishing Education Savings Accounts in Mississippi, we have prepared the following briefing note, and sent it to every lawmaker.

No one that reads it can credibly claim that there is a constitutional impediment to school choice in our state.

I recently came across an old McDonald’s menu from the early 2000s. A Quarter Pounder cost $2.29. A regular shake $1.69. Large fries $1.59.

Today, you would need to pay about twice that. Two decades of inflation – particularly in the past three years - means that a dollar buys much less than it did back then.

We are all familiar with the idea that prices rise over time. Ever since the US Federal Reserve broke the link between the US dollar and gold in August 1971, inflation has become a permanent part of life.

If, however, we measure price changes in constant dollar amounts (what economists call “real terms”), or if you consider how long it might take someone on the median income to earn enough to buy something, we can get a much more accurate picture of how prices have changed.

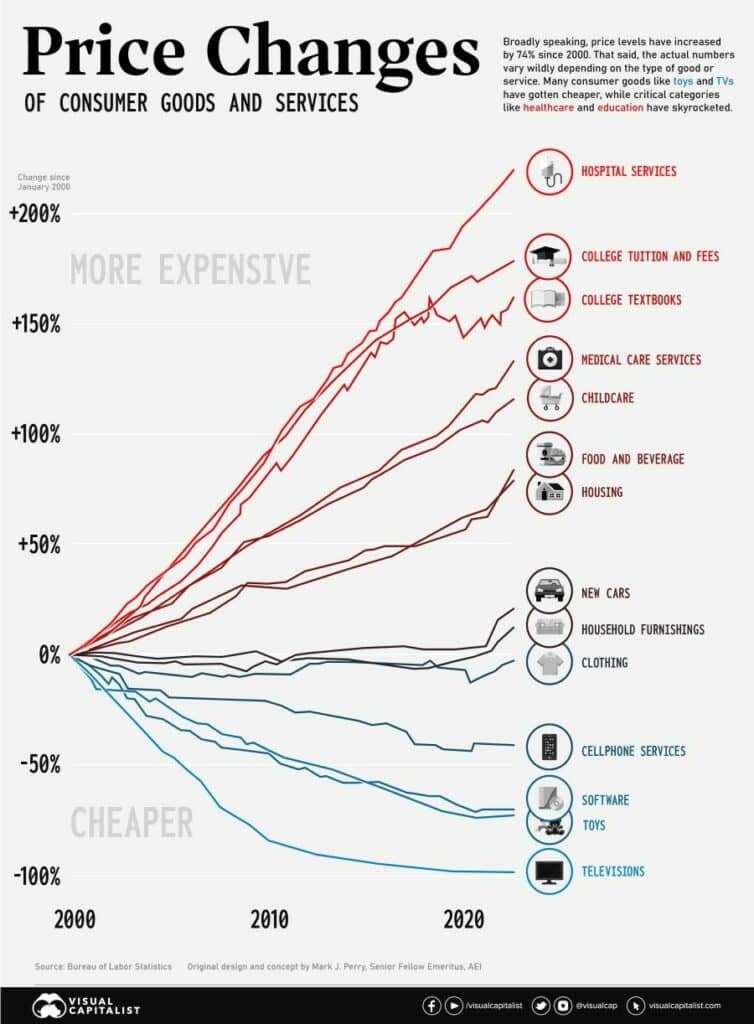

The chart above from Visual Capitalist shows how the price of various consumer items has changed since the start of the century.

US households get a far better deal when they buy toys, televisions or cellular services than was the case twenty years ago. The price of TVs in real terms has plummeted. A large flat-screen TV in 2000, according to VisualCapitalist, cost about 17 percent of median income. Today? Less than 1 percent of (a much higher) median income.

That’s the good news, but the bad news is that the price of other items has skyrocketed whichever way you measure it. Over the past two decades, the price of hospital services has risen over 200 percent. College tuition is up almost 170 percent.

Why have the costs of some things fallen so dramatically, but the costs of others risen?

Anyone wanting to sell you cellular services, or a TV, or toys in America today is operating in a fiercely competitive market. They are under constant pressure to give customers a good deal.

At the same time, companies in those sectors often operate globally, meaning that they benefit from the advantages of international trade, and can then pass those gains on to their customers.

What about the healthcare economy or higher education? There simply aren’t the incentives for providers in those sectors to give customers a better deal.

Not only is there less competition in these sectors, but they are protected by government regulation and barriers to entry that intentionally keep out the competition.

Here in Mississippi, for example, in order to provide a new healthcare facility, a provider will usually have to get a permit – called a Certificate of Need. Since these permits usually require the approval of existing healthcare providers, they are notoriously difficult to obtain.

Prices are determined via costly negotiations with insurance companies, rather than by pressure to keep giving customers a better deal.

A good rule of thumb is that prices have fallen whenever there is choice and competition, and government regulation is limited. Where there is lots of government regulation, prices have soared.

No one in Washington, as far as I know, has yet come up with a plan to make televisions or toys more affordable. Yet that is what the current administration is proposing to do for healthcare and higher education when they propose more Medicaid and student loan cancellation.

Ironic, isn’t it? Having made healthcare and higher education insanely expensive through regulation, government then comes along with an offer to make them more affordable to some.

What we ought to do instead is to abolish Certificate of Need laws and incentivize providers to offer customers, not just insurance companies, a better deal.

Rules on university tenure need to go, so that instead of running colleges for the convenience of those on the payroll, they are run in the best interests of those that save desperately in order to be able to afford to graduate. We also need to change the law on university accreditation so that there is less box ticking about diversity and inclusion, and more emphasis on how a degree actually adds value for students.

If there was a free market in healthcare and higher education, the cost of both would come down. If we don’t deregulate either sector, prices will continue to rise.

Talking of excessive regulation keeping out the competition, I was dismayed to hear that this week the Mississippi Charter School Authorizer Board only approved a single new Charter School in 2023.

This means that a decade since Charter Schools were allowed under Mississippi law, we have a grand total of eight. Our Authorizer Board has been cheerfully rejecting more applications than it has approved to the point that I think it is a minor miracle that anyone bothers to apply at all.

If Mississippi had an Authorizer Board for fast food outlets, McDonald’s Quarter Pounders would be an expensive luxury. The only way our state will see a significant increase in Charter Schools is if we actually appoint people to run the Authorizer Board that believe in school choice.

Douglas Carswell is the President & CEO of the Mississippi Center for Public Policy.

What’s the difference between a tax cut and a tax rebate? This question may feature prominently during the current legislative session in Jackson.

A tax cut means lowering the amount of tax taken from you by the government. A tax rebate, on the other hand, means the government giving back some of what it has already taken from you.

A cut in taxes is recurring. Unless and until our lawmakers vote otherwise, the amount you pay goes down. With a tax rebate you get a one-off grant – given in an election year.

Mississippi currently has record cash reserves and a large state budget surplus. Being an election year, you won’t be surprised to hear that all our state leaders support the idea of letting taxpayers have more of their own money.

The question that divides them is should this be done as a one-off rebate or as a more permanent reduction in the cost of government?

I am not against a tax rebate. Letting taxpayers keep more of their own money is always a good idea. I just happen to think that the rebate needs to be recurring; in other words, a tax cut.

Why would anyone be skeptical about a one-off grant given by politicians in an election year? You only need to ask the question to answer it.

In 2022, Mississippi’s leaders introduced the largest tax cut in our recent history, reducing the personal income tax rate from about 7 percent to 4 percent. This was a bold move and at a stroke, they made our state more competitive.

For the past thirty years, much of the southern United States has flourished. Tennessee, Texas, Georgia and Florida have prospered. Even Alabama is doing pretty well. Why?

The fastest-growing southern states have low taxes and light regulations. Far from having one-off tax rebates, Tennessee, Texas and Florida don’t have any income tax at all.

But what about our own state? Mississippi has not grown nearly as fast. If we want to be part of the southern success story, we need to cut our taxes to the low level that they are in some of the neighboring states.

In the 2023 legislative session, our lawmakers have the chance to put our state on the road to greater prosperity by giving us meaningful tax cuts, not just a one-off rebate.

Not a single conservative leader in Tennessee, Texas or Florida would run for office proposing the rate of personal income tax that we have in our state today, offset with a mere tax rebate. It is time for our leaders to be just as bold.

“But will we be able to afford it?” I hear you ask. Good conservatives should always make sure that the math adds up.

That is why the Mississippi Center for Public Policy published a Responsible Budget for our state at the start of this session. Working with a former White House economist, Vance Ginn, we show how our lawmakers can keep spending under control and use the large surplus that we have to make tax cuts – not a mere rebate – that we can afford.

Conservatives in the Mississippi legislature will spend plenty of time considering cultural issues in the 2023 legislative session. Let’s hope they don’t forget to address the economy, too.

When the Mississippi Center for Public Policy published a Conservative Platform for our state just before the start of the current session, we called for a Woman’s Bill of Rights to counter some of the more extreme ‘woke’ ideology that has started to infect sports. We also suggested a Parents’ Bill of Rights and proposed a new law to tackle ‘woke’ corporatism.

It’s great to see that these ideas are being taken up and a strong swell of support for them among our lawmakers. But conservatives also need ideas to improve the economy.

Here are some things that conservatives in the legislature should look to do this session.

- Cut taxes: Mississippi has a massive budget surplus plus the largest cash reserves in our history. At the same time, we have a higher tax burden than many neighbouring states. Using some of that cash surplus to reduce taxes would allow us to grow like some of the neighbours.

- Remove restrictive rules that increase health costs: Mississippi has some of the worst health outcomes in the country. One of the reasons is that Mississippi has some seriously restrictive rules that prevent new healthcare providers expanding. These so called certificate of need, or CON laws, need to go.

- Abolish boards: Downtown Jackson is full of state boards, agencies and commissions. Far from living in a free market state, the permission of these officials is often needed for all kinds of economic activity. Many of them should simply be scrapped. It was wonderful to read a report written by the legislature calling for the abolition of the barber board. Why stop with that? Free Mississippi’s economy and shut down more boards.

- Deficit reporting: How state agencies report their finances might seem deathly dull, but it matters. For far too long those that run agencies have been able to ask for last minute funds from the legislature. A bill is needed to set out deficit reporting requirements so that state funds can be properly managed.

- Allow more home-based businesses: Of course, HOA rules should be respected. But unless your HOA prohibits it, why not make it easier to run a business from your home if you don’t disturb the neighborhood?

Mississippi’s government spending (general fund appropriations) for the fiscal year 2024 should be no higher than $6.75 billion, according to a new budget report published today.

Any spending increased over and above $6.75 billion would expand the size of government in our state and reduce the scope of future tax cuts.

The Responsible Budget for Mississippi, authored by former White House economist, Vance Ginn Ph.D., applies a simple fiscal rule to determine how much spending should increase:

a) The level of spending (general fund appropriations) in 2023, plus

b) The rate of population growth and inflation.

“Conservatives serious about limiting the growth of government in Mississippi should not raise spending faster than inflation and population growth,” said Douglas Carswell, President & CEO. “To do so would be to expand the size of government and to limit the freedom for further tax cuts”.

When preparing the Responsible Budget, Ginn looked at how Mississippi government spending had grown over the past decade. He found that between 2014 and 2019, state government spending grew faster than population change plus inflation, meaning that the relative size of the state government in Mississippi increased. More encouragingly, however, since 2020 the expansion of the state government in Mississippi has slowed relative to inflation and population changes.

With projected general fund revenue collections of $7.5 billion for the FY 2024, a Responsible Mississippi Budget would result in an estimated surplus of $0.8 billion.

"Our Responsible Budget suggests that much of Mississippi’s budget surplus is structural, rather than cyclical. That means that provided we keep control of spending, the surplus will not simply disappear as and when the economy slows," Carswell said. "That means that there is room for tax cuts if we keep spending under control."

With a potential $0.8 billion surplus, Mississippi can afford to further reduce the state’s personal income tax rate as much as possible (e.g., from 4 percent as expected over time from recent tax cuts to 3 percent). The state could also reduce corporate income taxes.

A link to the Responsible Budget can be found here.

Mississippi Center for Public Policy CEO & President Douglas Carswell spoke to the South Rankin County chapter of Rotary Club.

Clubs or groups interested in having Douglas speak at a meeting or event can make a request at the link here.

On election day, we all get to decide who holds public office. But what if the person we elect proves to be a total dud? What if it turns out that they can scarcely run a bath, let alone a city?

Right now, there’s not a lot anyone can do besides sit back and watch the incompetence pile up until the next election rolls around. Good news for dud politicians, not such great news for everyone else.

Local people in Mississippi need to be given the power to recall local mayors that do not measure up. When the potholes keep growing and the homicide rates keep rising and boil water notices keep coming, there comes a point when local people should be able to act. If enough local residents sign a petition, it should be possible to trigger a simple ‘yes / no’ recall ballot.

“Giving people the power to recall a mayor” some might suggest “would ensure that mayors never take difficult decisions”.

Really? Isn’t that an argument against electing officials in the first place? Having public officials held accountable for what they decide to do in office is surely the essence of democracy.

A few mayors I can think of have managed to make some pretty terrible decisions. Had they known that they could be held accountable for their A-grade folly, they might not have made quite such a mess of things in the first place.

Any incumbent mayor reading this article would, I am sure, be quick to point out that they are already accountable. Mayors face re-election every few years, even without a recall ballot.

True, but come election day, voter choices are influenced by a myriad of factors. Some folk will be influenced by what is happening in the national news. Others might vote in a general election on the basis of broader questions of identity and party affiliation.

The beauty of a recall vote is its simplicity. Voters are invited to make a simple judgment as to whether the current officeholder is up to the job. It’s not about preferences for a particular party, or ‘their’ political side, or what they saw on Fox News or CNN the night before.

“Why only mayors?”, you might ask. “If recall is such a great idea, why not extend it to all elected officials?”

Put simply, because we need to start somewhere. Introducing a power of recall is going to be contentious. Rather like the issue of term limits, there will be no shortage of politicians who will come out against it. Turkeys don’t vote for Thanksgiving.

By applying the idea of recall elections initially to just mayors, we might just manage to achieve change.

Besides, recall elections work best when held locally. There is far greater proximity between local voters and their mayor than there is when it comes to state-wide elected officials. This means that local people are in a much better position to judge how their mayor is actually performing at their job.

I believe passionately in recall elections. So much so in fact that back when I was a Member of the British Parliament I even managed to recall myself. In 2014, fed up with the left-wing direction of the then “Conservative” government (no change there), I switched parties.

I did not have to, but I voluntarily resigned my seat in Parliament so that I could then face a special election – and the judgment of those I served locally. Voters overwhelmingly backed me. Public officials that have the support of the public have nothing to fear from recall votes.

Recall elections are an established part of America’s tradition of democracy. Right now nineteen other States in America have some form of recall. Allowing people in Mississippi to recall local mayors would bring us into line with what happens elsewhere.

In some sense, Mississippians already have the power to remove elected officials outside of ordinary elections. There exists buried inside the Mississippi code some provision to trigger the removal of those in office – but it is an arcane and archaic procedure that has seldom, if ever, been used.

Creating a right of recall that actually works is long overdue.

MCPP CEO & President Douglas Carswell was featured in an article discussing the Jackson water crisis. The story appeared in The Epoch Times.