I recently came across an old McDonald’s menu from the early 2000s. A Quarter Pounder cost $2.29. A regular shake $1.69. Large fries $1.59.

Today, you would need to pay about twice that. Two decades of inflation – particularly in the past three years - means that a dollar buys much less than it did back then.

We are all familiar with the idea that prices rise over time. Ever since the US Federal Reserve broke the link between the US dollar and gold in August 1971, inflation has become a permanent part of life.

If, however, we measure price changes in constant dollar amounts (what economists call “real terms”), or if you consider how long it might take someone on the median income to earn enough to buy something, we can get a much more accurate picture of how prices have changed.

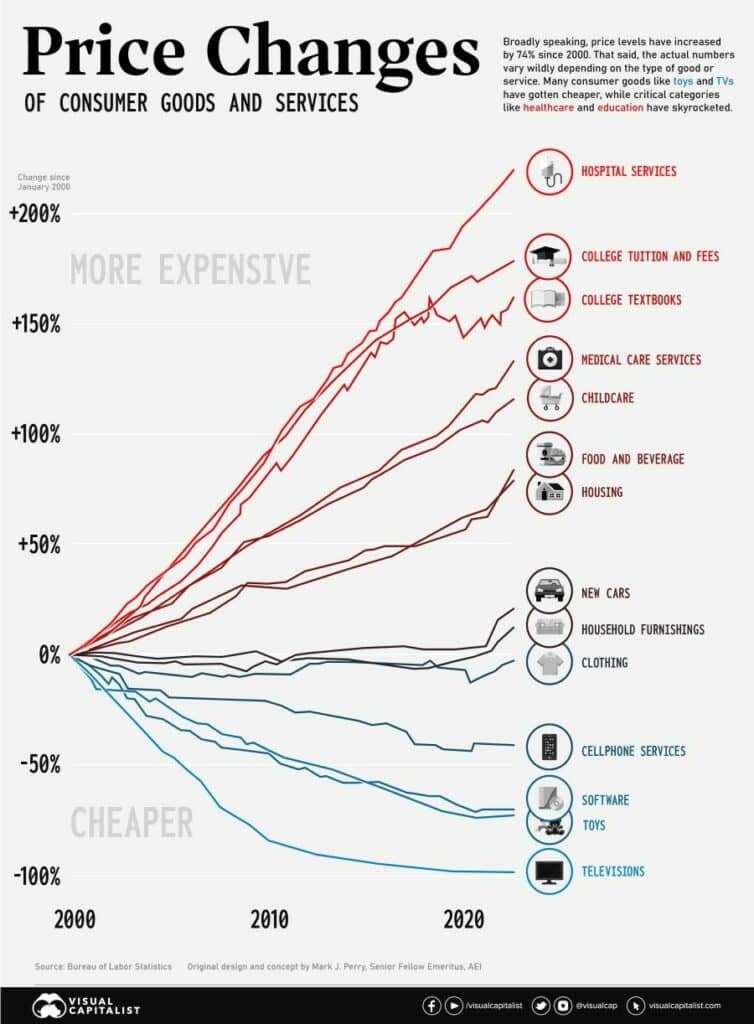

The chart above from Visual Capitalist shows how the price of various consumer items has changed since the start of the century.

US households get a far better deal when they buy toys, televisions or cellular services than was the case twenty years ago. The price of TVs in real terms has plummeted. A large flat-screen TV in 2000, according to VisualCapitalist, cost about 17 percent of median income. Today? Less than 1 percent of (a much higher) median income.

That’s the good news, but the bad news is that the price of other items has skyrocketed whichever way you measure it. Over the past two decades, the price of hospital services has risen over 200 percent. College tuition is up almost 170 percent.

Why have the costs of some things fallen so dramatically, but the costs of others risen?

Anyone wanting to sell you cellular services, or a TV, or toys in America today is operating in a fiercely competitive market. They are under constant pressure to give customers a good deal.

At the same time, companies in those sectors often operate globally, meaning that they benefit from the advantages of international trade, and can then pass those gains on to their customers.

What about the healthcare economy or higher education? There simply aren’t the incentives for providers in those sectors to give customers a better deal.

Not only is there less competition in these sectors, but they are protected by government regulation and barriers to entry that intentionally keep out the competition.

Here in Mississippi, for example, in order to provide a new healthcare facility, a provider will usually have to get a permit – called a Certificate of Need. Since these permits usually require the approval of existing healthcare providers, they are notoriously difficult to obtain.

Prices are determined via costly negotiations with insurance companies, rather than by pressure to keep giving customers a better deal.

A good rule of thumb is that prices have fallen whenever there is choice and competition, and government regulation is limited. Where there is lots of government regulation, prices have soared.

No one in Washington, as far as I know, has yet come up with a plan to make televisions or toys more affordable. Yet that is what the current administration is proposing to do for healthcare and higher education when they propose more Medicaid and student loan cancellation.

Ironic, isn’t it? Having made healthcare and higher education insanely expensive through regulation, government then comes along with an offer to make them more affordable to some.

What we ought to do instead is to abolish Certificate of Need laws and incentivize providers to offer customers, not just insurance companies, a better deal.

Rules on university tenure need to go, so that instead of running colleges for the convenience of those on the payroll, they are run in the best interests of those that save desperately in order to be able to afford to graduate. We also need to change the law on university accreditation so that there is less box ticking about diversity and inclusion, and more emphasis on how a degree actually adds value for students.

If there was a free market in healthcare and higher education, the cost of both would come down. If we don’t deregulate either sector, prices will continue to rise.

Talking of excessive regulation keeping out the competition, I was dismayed to hear that this week the Mississippi Charter School Authorizer Board only approved a single new Charter School in 2023.

This means that a decade since Charter Schools were allowed under Mississippi law, we have a grand total of eight. Our Authorizer Board has been cheerfully rejecting more applications than it has approved to the point that I think it is a minor miracle that anyone bothers to apply at all.

If Mississippi had an Authorizer Board for fast food outlets, McDonald’s Quarter Pounders would be an expensive luxury. The only way our state will see a significant increase in Charter Schools is if we actually appoint people to run the Authorizer Board that believe in school choice.

Douglas Carswell is the President & CEO of the Mississippi Center for Public Policy.