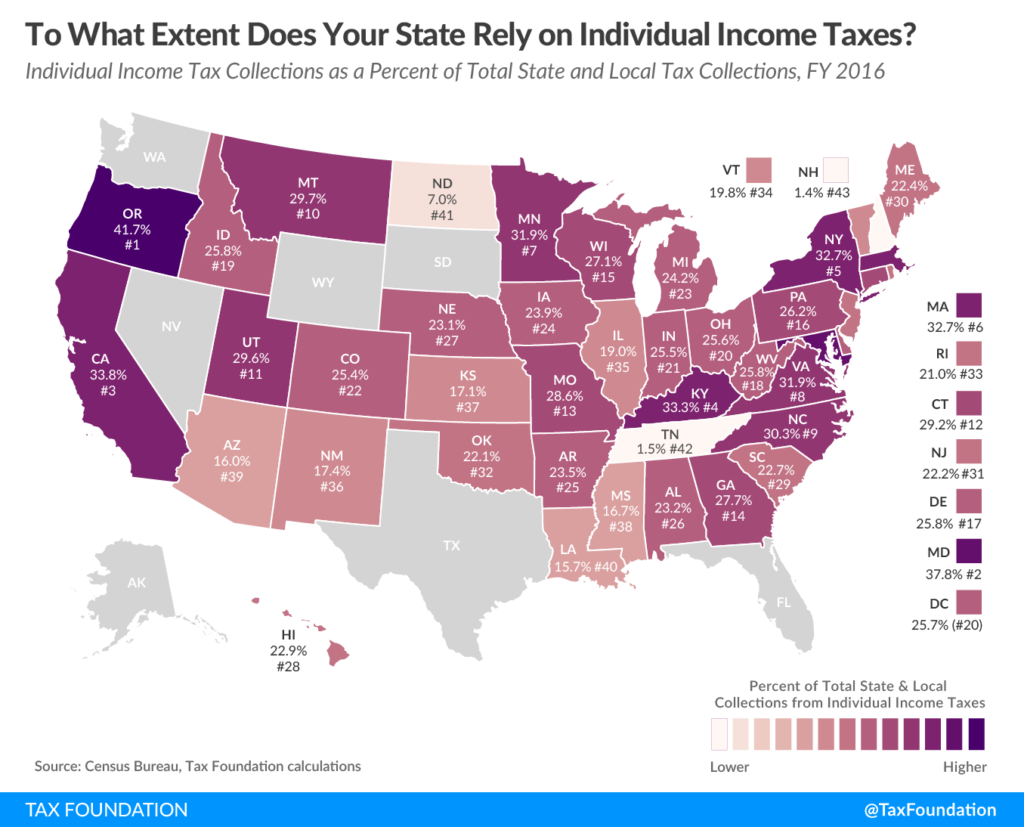

That is one of the lowest percentages in the country among state’s that collect income taxes. According to the Tax Foundation, Mississippi came in at 38th lowest, behind just Arizona, Louisiana, and North Dakota.

Arkansas and Alabama were both middle-of-the-pack at 23.5 percent and 23.2 percent, respectively.

Oregon and Maryland relied most heavily on individual income taxes, at 41.7 and 37.8 percent, respectively. In Oregon’s defense, they do not charge a sales tax, contributing to the heavy reliance on income taxes.

Still, there is a better way to levy taxes. Mississippi should follow the model of neighboring Tennessee, which does not collect income taxes. (Tennessee does have a tax on investment income, known as the “Hall Tax,” but that will be fully repealed by 2021.)

Because how a state chooses to collect taxes has far-reaching implications. Income taxes tend to be more harmful to economic growth than sales taxes or property taxes. After all, sales and property taxes tax people on what they spend. Income taxes tax you on what you earn, either through labor or savings. Income taxes are also a less stable source of tax revenue, as individuals are more likely to experience more volatility with income than consumption.

Mississippi has begun the process of moving to a flat-income tax, with the phase out of the three percent tax bracket over several years. That is a good start. We have also debated legislation that would make recent graduates eligible to receive a rebate up to the full amount of their individual state income tax liability after they work in the state for five years. Essentially, Mississippi would be an income tax free state for a few years after graduation in an attempt to attract young talent to the Magnolia State.

That is a good thing. We should just expand it to everyone. By following the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a smaller government, we will be able to offer opportunities for people regardless of their age or their industry.