According to the latest data from the Census Bureau, American households have made their way solidly out of the recession and incomes continue to rise. And the report includes other significant data: Income inequality is more of a talking point than a reality and middle-income earners are actually moving up the economic ladder, not down. All while, the price of consumer goods continues to go down.

Median household income last year was $61,372, an increase of 1.8 percent from the previous year in today’s dollars. This is the fifth consecutive annual increase after a half-decade of declines following the Great Recession. The last period of four consecutive gains was in the late 1990s.

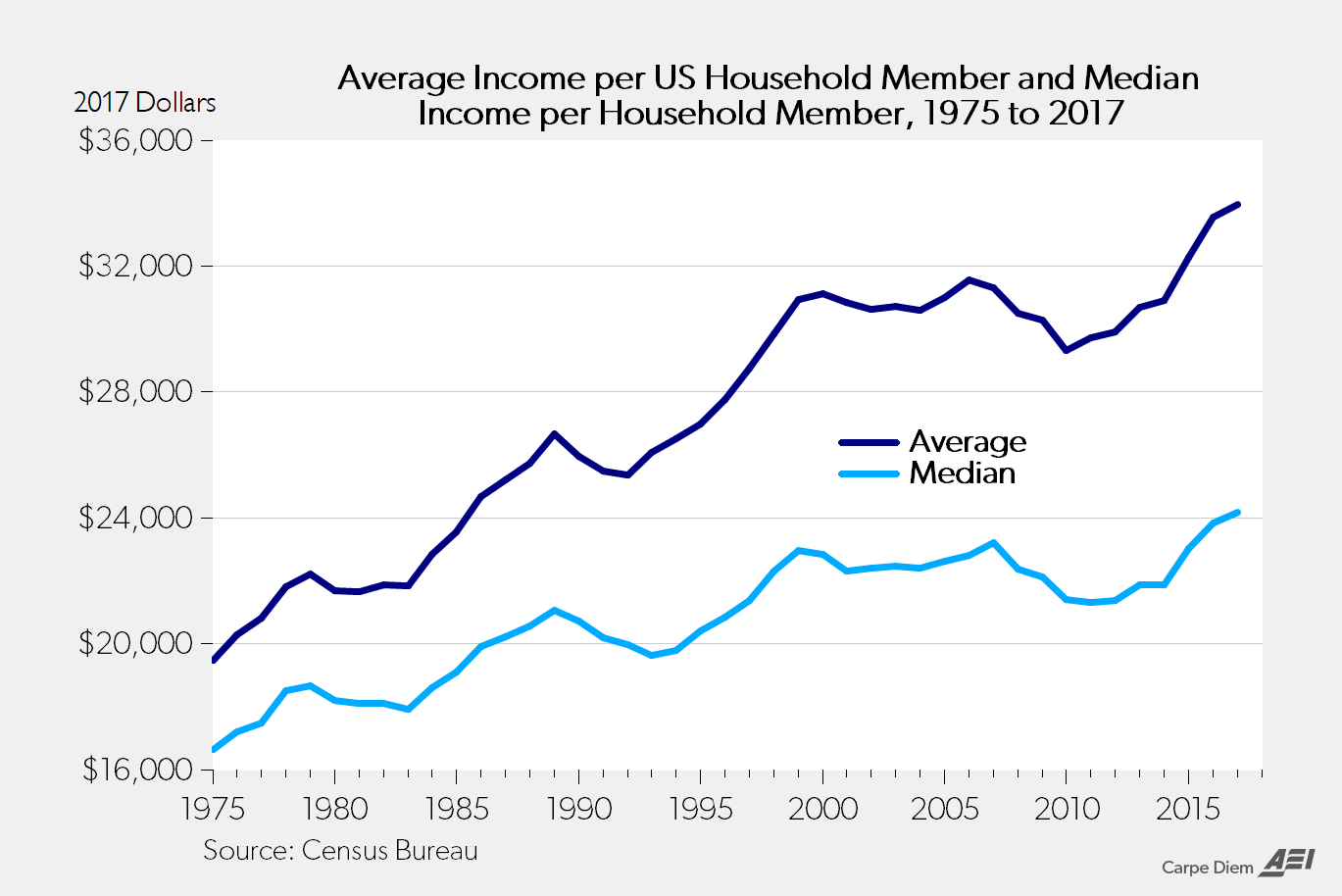

Compared to 1975, annual incomes per household member, again in today’s dollars, are up more than $12,000. That means each America has an additional $1,000 in additional income per month than they did forty years ago.

One of the most common refrains we hear in politics today is about the rising income gap. It has spurred a new belief in socialism, and propelled the candidacy of Democratic-Socialist Bernie Sanders in 2016. Other have since followed in his footsteps.

President Barack Obama once called it the “defining challenge of our time.”

Two data points show that the shares of total income earned by the top 20 percent and the top 5 percent are relatively static. Meaning, the rich aren’t getting richer at the expense of everyone else. Over the past two decades, the income shares of the top 20 percent and the top 5 percent have remained stable at 49-51 percent and 21-22 percent, respectively.

As the chart shows, these percentages are relatively static during this time.

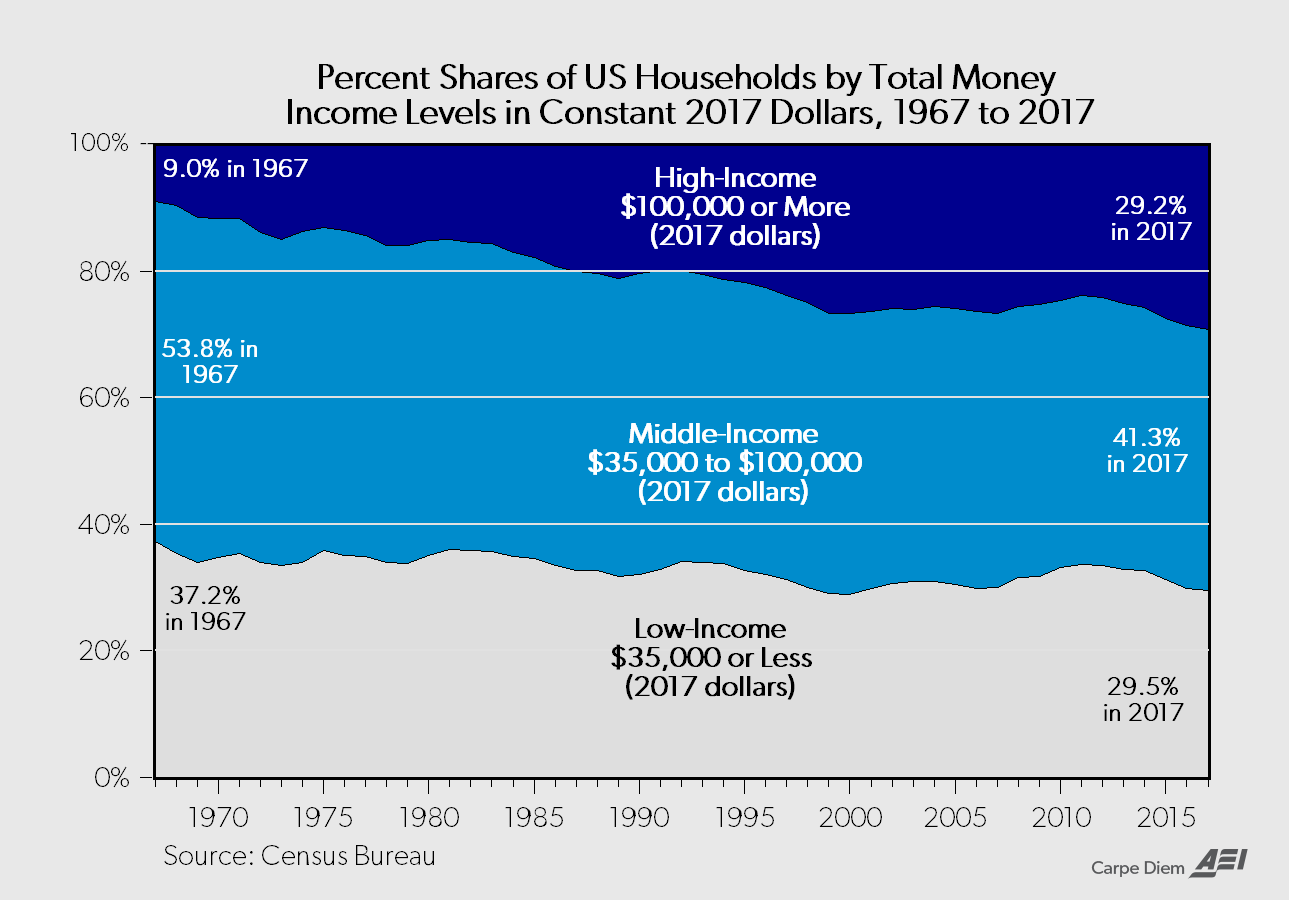

Another common refrain is the disappearing middle class. After all, in 1967 53.8 percent of the population was considered middle income, those who make between $35,000-$100,000 (in today’s dollars). But the middle class is getting smaller because they are moving up to higher income groups. That is a good thing.

The size of high-income earners, those who make $100,000 or more is 29.2 percent. Forty years ago, only 9 percent fit in this category. That represents a growth of high earners of 224 percent. Meanwhile the share of low-income earners, those who make $35,000 or less, has fallen from 37.2 percent in 1967 to 29.5 percent today. A decrease of 20 percent.

Usually involved in this discussion is the fact that everything seems much more expensive than it was a few decades ago. A lot of this is nostalgia, but there are some items that are indeed more expensive, significantly more so in many cases. That primarily includes healthcare and higher education, two sectors of the economy that are heavily regulated and influenced by the government.

Housing, which is often negatively impacted (in terms of cost to the consumer) by local government regulations, has largely kept pace with inflation.

But most every day consumer goods, everything from cars and home furnishings to appliances and clothing, have become more affordable. What do these goods have in common? They are controlled by the free market, not the government.

For some, they may be struggling. They may not have bounced back from the recession or perhaps life choices put them in a less-than-desirable situation. But we know, when we move past the talking points and political campaigns, Americans have never been doing better. The middle class isn’t shrinking. It’s getting wealthier. Incomes are not growing apart. And every day purchases aren’t getting more expensive.

Thanks to capitalism and the free market.