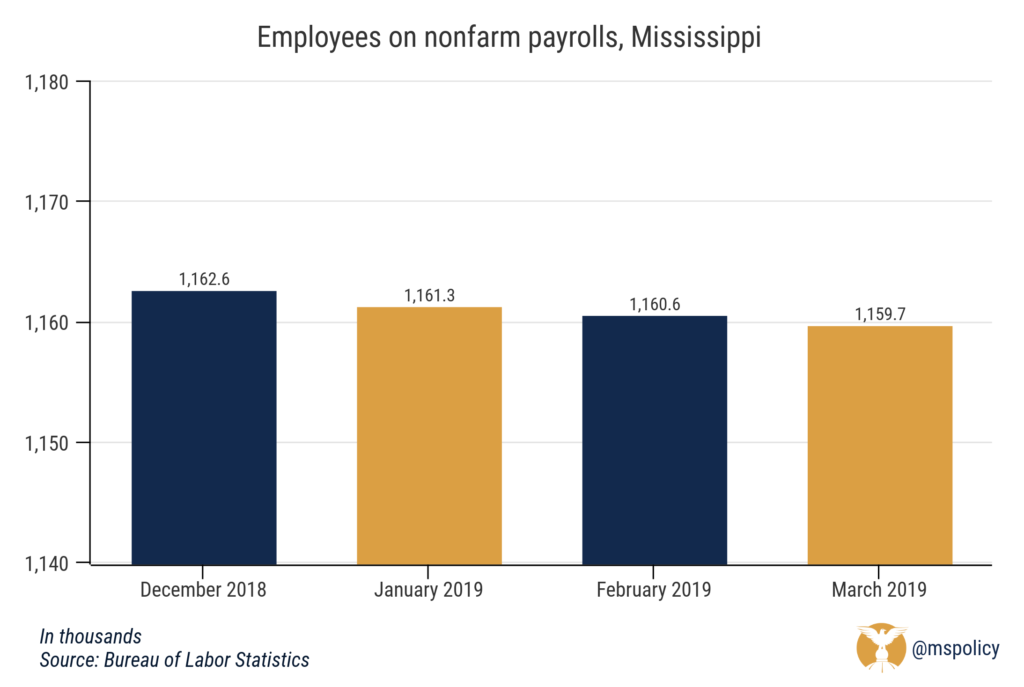

In December, nonfarm payrolls in Mississippi reached 1,162,600. But after three months of decreases, payrolls were down to 1,159,700 in March. Preliminary estimates from February initially showed a slight increase to 1,161,900, but those numbers were revised down to 1,160,600.

This is a reversal of 2018 when Mississippi added about 11,000 jobs for a modest job growth rate of one percent.

Over the past month, Mississippi saw employment gains in construction (+500), financial activities (+100), and leisure and hospitality (+100). However, the state experienced reductions in manufacturing (-500), trade, transportation, and utilities (-400), professional and business services (-400), education and health services (-100), and government (-100).

Nationally, the country has added around 540,000 jobs over the first three months of the year. Mississippi’s job growth rate of -0.25 percent came in 44th among the 50 states. Among Mississippi’s neighbors, Alabama was the top performer, growing at a rate of 0.47 percent.

| State | Job growth rate | National ranking |

| Alabama | .47% | 17 |

| Arkansas | .28% | 26 |

| Louisiana | .12% | 35 |

| Mississippi | -.25% | 44 |

| Tennessee | .22% | 30 |

For Mississippi’s neighbor to the east, this is a continuing trend of strong numbers. In 2018, Alabama had a job growth rate of 2.13 percent.

Idaho had the greatest percentage change in employment during the first quarter at 1.19 percent, followed by West Virginia (1.05%), North Carolina (.91%), Oregon (.90%), and Maine (.78%).

What can Mississippi do better?

Mississippi has the fourth largest government share of state economic activity, and that is due to state and local spending, not federal funds. While there is a large contingent who would want to see the government spend more, it would actually be pretty difficult.

When the government grows, the state has increased ownership and the private sector shrinks. And economic freedom, which is based on free markets and voluntary exchange, individual liberty, and personal responsibility, wanes.

According to the most recent Fraser Institute Economic Freedom of North America report, which measures government spending, taxes, and labor market freedom, Mississippi was ranked 45th among the 50 states. Similarly, Cato Institute’s Freedom in the Fifty States, which measures economic and personal freedom, placed Mississippi 40th in their most recent rankings.

What is the correlation between economic freedom and prosperity? The freer states are more prosperous, have higher per capita incomes, more entrepreneurial activity, and lower poverty rates. We have the model. Similar states have experienced economic growth by adopting freedom-based policies. And it is important to know the difference between the reality of economic growth and the practice of economic development; those can be very different things. There is a role for corporate recruitment and economic development, but that can’t be the main driver of sustainable economic growth.

Government incentives, often in the name of economic development and being ‘business-friendly,’ attempt to recruit businesses to the state through financial benefits, such as site preparation, infrastructure, job training, or special tax breaks. In most cases, the reason incentives are necessary is because of higher taxes or policies that burden businesses. In some cases, incentives are necessary because corporations take advantage of a highly competitive economic development and play the states against one another. There is a better way for us to play this game.

Instead of special incentives for a few, Mississippi should work to provide a favorable climate for every business. Let the market decide where a business locates or expands. An economic development officer can sell low taxes and low regulatory burdens to a company looking for a great location like Mississippi. What’s more, the data shows us that such policies allow existing businesses, already in our state, to expand and grow from a small employer to a large employer without getting any incentives from the taxpayers. Those are the best jobs. That’s sustainable economic growth.

To their credit, state leaders have attempted to improve the economic climate of Mississippi, most notably through tax and regulatory reform. In 2017, the legislature adopted a new law that will require all new licensing regulations to be approved before they take effect, ensuring new attempts to stifle competition will be reviewed before they are finalized.

And the Taxpayer Pay Raise Act in 2016 will eliminate the three percent income tax bracket, allow self-employed individuals to deduct half of their federal self-employment taxes, and remove the franchise tax on property and capital when fully implemented. Even though Mississippi’s overall tax burden is still above the national average, this will move Mississippi closer to a flatter income tax and make our business climate more competitive.

These reforms weren’t easy, but showed forward thinking to align us closer with neighboring states. Making the case for spending more money on your favorite government program is not a path to prosperity. We need to think much bigger and much smarter. If we want to do better than the bottom ten in categories like per capita income, it starts with doing better in categories like business friendliness, regulatory practices, entrepreneurial environment, private capital encouragement, and tax rates.