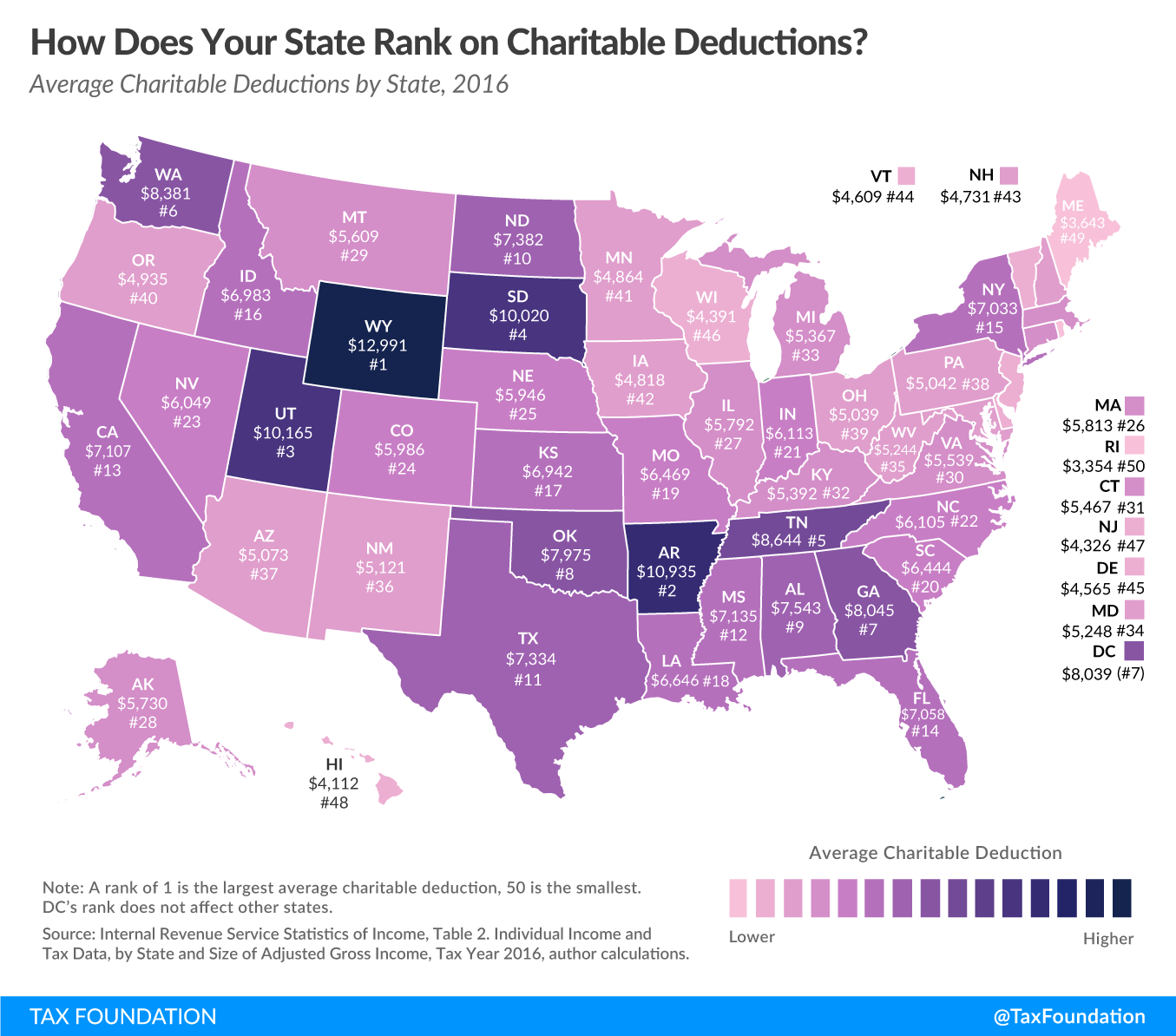

According to the IRS, some 250,000 Mississippians took an itemized deduction for charitable giving last year. The average deduction in the Magnolia State was $7,135. This is the 12th highest average in the country.

The top five charitable states were Wyoming ($12,991), Arkansas ($10,935), Utah ($10,165), South Dakota ($10,020), and Tennessee ($8,644).

Along with two of Mississippi’s neighbors coming in the top five nationally, Alabama placed ninth at $7,543 per contribution and Louisiana was 18th at $6,646 per contribution.

The five least charitable states were Rhode Island ($3,354), Maine ($3,643), Hawaii ($4,112), New Jersey ($4,326), and Wisconsin ($4,391).

As a note, this isn’t necessarily total amount of giving, but the total amount that eligible taxpayers deducted on their income taxes in 2016. A donation that was made but not reported on tax filings would not be counted in this report.

And as the standard deduction will be increased because of the Tax Cuts and Jobs Act that passed last year, it is assumed that far fewer individuals and families will itemize their deductions this year. That will impact tax filings, but what effect it has on actual charitable giving remains to be seen.