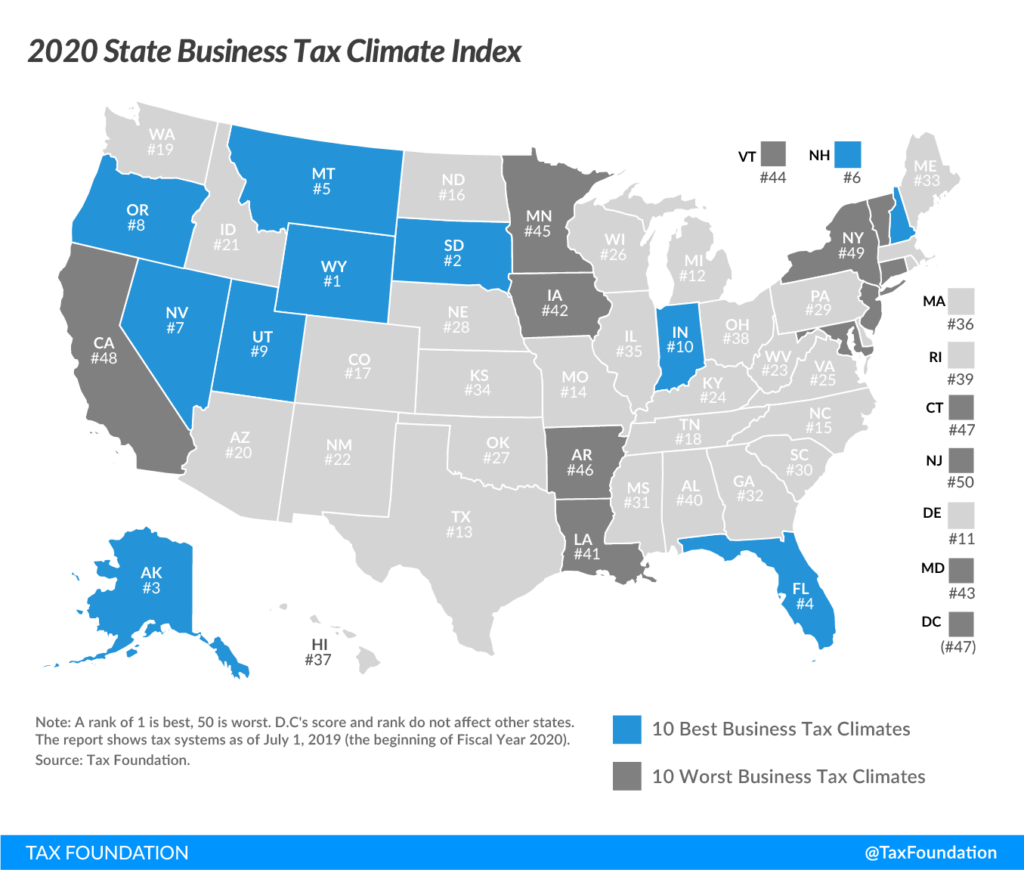

The Tax Foundation placed Mississippi 31st overall for taxes, including corporate, individual, sales, property, and unemployment insurance taxes. The only neighboring state to do better was Tennessee. Alabama, Louisiana, and Arkansas were rated 40, 41, and 46 respectively.

Wyoming was again the top-rated state, followed by South Dakota, Alaska, Florida, and Montana. The bottom five states, beginning with number 50, were New Jersey, New York, California, Washington, D.C., and Connecticut.

According to the Tax Foundation, the top states share a few similarities.

“The absence of a major tax is a common factor among many of the top 10 states,” according to the report. “Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax. Wyoming, Nevada, and South Dakota have no corporate or individual income tax (though Nevada imposes gross receipts taxes); Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire, Montana, and Oregon have no sales tax.”

Mississippi dropped a spot from last year. The state received its best marks for unemployment taxes (5th best) and corporate taxes (10th best). The corporate tax component measures impacts of states’ major taxes on business activities, both corporate income and gross receipts taxes. The unemployment insurance tax component measures the impact of state UI tax attributes, from schedules to charging methods, on businesses.

Mississippi’s worst tax categories were property and sales. It would be a good idea to lower our business tax burden on land, buildings, equipment, and inventory.

Mississippi has begun phasing out its capital stock tax, following an exemption added in 2018 with the first-rate reduction, from 2.5 to 2.25 mills, in 2019. The tax will slowly phase out through 2028, but the modest rate reduction is not enough to move the needle on Index rankings.