Between a pandemic, murder hornets, and so much more, it is perhaps little surprise that studies have consistently found that Americans are drinking more alcohol during quarantine. In states around the country liquor stores and small businesses that deliver alcohol have seen an uptick in sales.

Mississippi, thanks to the infinite wisdom of our legislative class, has decided that we do not want to see the same economic gains and tax revenue brought forth from an increase in demand like in other parts of the country. An antiquated operations model that places a distribution monopoly within the hands of a single government entity and a series of laws that bar delivery and shipment of alcohol have handicapped the liquor industry in the state and desperately need to be reconsidered.

Liquor store owners in and around Jackson are saying that their deliveries are two weeks behind schedule.

Customers have long complained about the inability to get common alcohol selections due to the cutting of products from the Alcoholic Beverage Control (ABC) warehouse.

Responding to the present issues, Sen. Josh Harkins (R-Flowood) recently stated, “[W]e’ve got some incredible employees out there right now they’re limited in what they have the ability to properly distribute the product so we’re just trying to make it more efficient.”

While having employees is nice, a government program should not exist solely to offer jobs. Just because government can make money performing an operation does not mean that operation becomes a legitimate scope of government.

A few months ago, ABC officials said that orders had risen 29 percent and that they were considering suspending new orders. They ultimately announced a suspension of all orders from July 10 through July 20 before giving in to allow for more placements. Such drastic measures showcase the current inability of ABC to respond to changing market demand. While some suggest that the department simply needs more taxpayer resources, and a larger warehouse, a more dramatic solution is necessary.

ABC is perfectly making the case against its own existence and for privatization of their work. Government consistently proves itself to be an inefficient allocator of resources, and its departments are woefully unable to respond to rapid changes in the market context in order to adapt. Private distributors have greater flexibility to expand and contract depending on the performance of the market and thus should be empowered to do so.

One need only look to the most extreme example of late to see how the market ultimately reacts to changes in demand. When toilet paper sales spiked and aisles ran empty, stores kicked up their orders, and private distributors delivered, and yet months on, our government is still failing to respond effectively to a demand uptick that pales in comparison to the one for toilet paper over this year.

What purpose does Mississippi government have in the alcohol distribution business anyway? Government should no sooner step in to start distributing fried chicken and biscuits. Either way, it is a ridiculous misutilization of our tax dollars.

However, our legislators not only continue to invest in an antiquated system that is unable to fulfill the requests of both businesses and consumers, they also go so far as to block private entrepreneurs from delivering alcohol.

In states around the country apps such as Postmates, Drizzly, and others have helped make shopping easier by reducing the number of people in physical store locations at any given time. They have done so through vast delivery networks which allow one to get alcohol products delivered to one’s door just as food, groceries, and other commodities are readily delivered.

Unfortunately, due to a lack of foresight on behalf of our government, our legislators chose to continue restricting this freedom, eliminating potential new jobs, and necessitating people go into physical liquor stores during a pandemic.

Altogether, Mississippi alcohol policy continues to be defined by our unique history with prohibition. As the first state to enact it and the last to officially end it, the ramifications of this remnant of a bygone era continue to make themselves known. The new strains placed on ABC by changes in market demand call for a reevaluation of government control over alcohol distribution.

And, while we’re at it, let’s go ahead and let people use 21st century technology to order alcohol too.

Wendy Swart was a cosmetologist in Pennsylvania for more than 30 years. Dana Presley cut hair in Florida for more than a decade. Dawn Roy was a teacher in Arkansas.

What do each of these women have in common? They were all professionals licensed in other states who moved to Mississippi ready to work, only to receive a red light from government upon entering what we call the Hospitality State.

Wendy’s husband landed a job in South Mississippi, necessitating the move. Similar story with Dana, whose husband began working at Mississippi State. They thought transferring their cosmetology licenses, which had spotless records, would be easy. The same is true of Dawn. She moved back to Mississippi to be near family. Yet while we often hear of teacher shortages, she continued to run into trouble in getting a license.

In a state that is losing thousands of residents each year and had the highest unemployment rate in the country pre-pandemic, we are making it hard for those actually moving to Mississippi and wanting to work here. It makes no sense to allow the government to obstruct an individual’s ability to work and earn a living.

If our goals are to encourage people to move to Mississippi and to make it easier to work, that can – and should – change.

Last year, Arizona became the first state in the nation to provide universal recognition for occupational licenses, even if the state you are moving from won’t recognize a license you received in Arizona. The premise is simple: If you learned to cut hair in, say, Florida or Pennsylvania, you should be able to cut hair in Mississippi. Common sense would tell us you don’t forget how to practice a skill you’ve dedicated your life to just because you cross state lines.

What has that meant for Arizona? In one of the fastest growing states in America, in the past year over 1,100 new Arizonans have applied for and been granted a license to work in the Grand Canyon State in fields ranging from cosmetology to engineering.

Multiple bills were introduced this year to bring such a law to the Magnolia State. It’s much needed, but all bills died in committee without consideration. While Mississippi punted, Montana, Pennsylvania, Utah, Idaho, Iowa, and Missouri all followed Arizona.

The reason such a law is necessary is because many boards in the state claim to offer reciprocity. Yet those boards are tasked with trying to compare education or training across the 50 states, either delaying your ability to work for an extended period of time or preventing you from working at all. Often, they will demand you take new classes to re-learn what you’ve already been taught, requiring an investment of both time and money.

A similar measure exclusively for military families was signed into law this year. Now, applicants in military families are eligible to receive a license if they have held a license in good standing for at least one year and they completed testing or training requirements in the initiating state. If you come from a state that does not require a license in a field that Mississippi does, you have a clear pathway to licensure if you have worked for at least three years in that field. Moreover, boards are required to issue a temporary license if an application may take longer than two weeks to process.

Those are all great steps that could help steer the state’s economy in the right direction. It just needs to be expanded. After all, today, about one in five need a license to work, a strong contrast from the 1950s when just five percent of the population needed permission from the government to earn a living.

It should not be this difficult to work in Mississippi. For a state that has been on the wrong side of domestic migration over the past half-decade and during a time of economic uncertainty, we should be welcoming new residents with open arms to the state. Instead, we are putting up roadblocks.

Let’s remove government barriers and make it easier to work.

This column appeared in the Starkville Daily News on September 4, 2020.

“In late March my husband was diagnosed with coronavirus. He was one of the first in Mississippi to be diagnosed with coronavirus.

“Therefore, I could not go back to work. I was able to work from home for a few weeks, but eventually between not being able to be present on site and the business struggling, the business made the decision to close down the plant.

“Since then I’ve been trying to put my skills in the food processing industry to use. I was trying to come up with ways to help supplement our family’s income. I started going through the cottage food laws and finding different products that I can legally make from my house and sell.

“I’ve experimented with a few different breads. I make white bread, zucchini bread, and a couple herbs breads as well. That was where I really started. I then began experimenting and created ginger syrup. I didn’t know what to do with it at the time, but it smelled so good I put it in my sweet tea, and after I tasted it, I realized this should be a thing.

“So far I’m doing pretty well. I’ve had great success with advertising online. People really like the message. They like the homemade, purest ingredients.

“There are some struggles. I’ve been trying to get into a few farmers markets, but because of the policies, I’m deemed not essential enough. I’ve been blessed to stumble upon the Legacy Co-Op in Brandon and they have given me an avenue to be able to sell my products.

“This has helped supplement the family. But it’s also given me the wonderful opportunity to spend more time with my daughter. I have a three-year-old little girl and for the most part the grandparents were raising her. I’ve been having that one on one mommy and daughter time to teach and that was just not something I was able to do in the past working 50 to 60 hours per week.

“So, it’s been a blessing to spend more time with that baby and to teach her that anything can happen, and anything is possible.”

Leslie Stingley

Homestead By The Brambles

Morton, Mississippi

Leslie Stingley launched her cottage food business this spring when she lost her job shortly after the pandemic began. It’s been a lifeline for her family.

Mississippi is one of 49 states that have a cottage food law that allows producers to sell food they make free of government regulations. This allows entrepreneurs to sell certain non-perishable foods they make at home to willing consumers. There is no state registration required, nor do you need the state to inspect the same kitchen that you also prepare family meals from.

Leslie is excited for where her business is headed and the potential to supplement her family’s income, but she’s still limited in what she can sell – and how much she can earn.

While the cottage food law allows limited freedom to small producers, the food products you offer must be on an approved list, and you must earn below a state-mandated sales cap, discouraging growth and expansion. There is more we can do to empower small farmers and small businesses and allow consumers to purchase the food they want to eat.

Because while food producers of all sizes have historically provided their delicious products to consumers, the rise of the regulatory bureaucracy has squeezed out smaller producers. Today, these farmers and small-scale food producers can be considered criminals – and that ought to change. It’s good for small businesses. It’s good for consumers.

The regulation of food processing began as the food we consumed moved further from our backyard and we became a largely urban nation. In a sense, that regulation is necessary. We have no idea where our food comes from and want to make sure it is safe to eat. Inspections and regulations were therefore designed to protect us from bad actors whom we could not see or have necessary information about to make an informed choice before buying their product.

But as usually happens with government regulations, large businesses – with access to monetary and political capital – began to demand more regulations to stifle smaller competition that couldn’t accommodate the burden as easily. And that trend remains. That is why industry groups usually favor regulations that place their smaller rivals at a competitive disadvantage.

In this case, it is small farmers who cannot operate in an environment more suited for large-scale operations. Unfortunately, the state and federal government have created a significant barrier to entry for all but a few, stifling the local and diverse food culture created by small producers.

But it doesn’t need to be this way.

Five years ago, Wyoming launched the modern food freedom movement. Food producers there are now exempt from “licensure, permitting, certification, inspection, packaging, or labeling regulations when selling food” to an “informed end consumer.” Utah, Maine, and North Dakota have followed suit with similar laws.

Under such as a law, you can sell only to the end consumer within your state, it must be used only for home consumption, and you are required to label that the food has not been inspected.

The basis of any food freedom law is that the consumer is required to inform themselves about the product they are purchasing, who they are buying it from, the people behind the product, and the processes they use. Fortunately, today’s technology makes it even easier to find high-quality food, read reviews from happy (or unhappy) customers, and make knowledgeable decisions. Online reviews and apps are doing the job of a government inspector – and providing even more information to consumers.

Government regulations are often fashioned as being necessary for our health and safety. That is certainly a laudable goal, but it’s not an excuse to eliminate competition or declare individuals unable to make their own decisions. After all, there has not been a single outbreak of foodborne illnesses from food sold under these exemptions.

Mississippians who want to purchase food directly from a farmer or rancher, fully aware that it did not pass through traditional government barriers, should be allowed to do so.

This column appeared in the Starkville Daily News on August 21, 2020.

Wendy Swart has been a hairdresser for more than 30 years. So when she moved to Mississippi last year, she didn’t figure she would still be without a license – and without a job.

Wendy’s story began last August when her husband, Scott, landed a job in Mississippi and was preparing to move. She immediately contacted the Board of Cosmetology and was initially told her transferring should not be an issue. She would be working soon. Or so she thought.

The Board said she did not have enough hours, though she holds a teachers license that put her over Mississippi requirements. Instead, she was told she would need to take new courses, which would take time, cost money, and not pertain to the profession according to Wendy.

All to work in a profession that Wendy has devoted her career to. And never received an infraction, citation, or something similar.

There is some type of limited licensing reciprocity for cosmetologists in Mississippi, but it’s not exactly clear. Instead, Boards are devoting unnecessary time trying to compare education or training requirements across 50 states. And, as Wendy’s story shows, it doesn’t help people work, which should be our goal when qualified individuals move to Mississippi.

This is why Mississippi needs to follow the path of Arizona in adopting universal licensing for occupational licenses. In Arizona, over 1,100 individuals have applied for and been granted a license to work in fields ranging from cosmetology to engineering in just one year.

Multiple bills were introduced this year to bring such a law to the Magnolia State. The premise is if you’ve received an occupational license in another state and have a clean record, you can start working almost immediately. It’s much needed, but all bills died in committee without consideration. While Mississippi punted, Montana, Pennsylvania, Utah, Idaho, Iowa, and Missouri all followed Arizona.

A similar bill exclusively for military families has been signed into law. It has the potential to benefit many but needs to be expanded.

It should not be this difficult for someone who has 30 years of experience and has never had a knock on her record to work in Mississippi. For a state that has been on the wrong side of domestic migration over the past half-decade and during a time of economic uncertainty, we should be welcoming new residents with open arms to the state. Instead, we are putting up roadblocks.

As the recent coronavirus pandemic has demonstrated, the healthcare system needs some rethinking and retooling. We are in great need of solutions that increase efficiency and quality while also lowering costs for providers and patients.

One such example is the problem of non-emergency medical transportation for Medicaid recipients. Millions of Americans miss their medical appointments each year. These no-shows reduce access for other patients. They also cost an estimated $150 billion a year by increasing administrative costs related to scheduling and rescheduling. In the context of Medicaid, these costs increase the price tag of Medicaid, which is a form of subsidized health insurance paid for by state and federal taxpayers.

Mississippi already offers generous transportation services for Medicaid beneficiaries, with no copay required. The amount allocated for the current Mississippi Medicaid non-emergency transport contract is $96.8 million for the period from October 2018 to September 2021. Total federal spending on non-emergency Medicaid transportation averages $3 billion a year. Could there be a way to reduce federal and state spending on non-emergency transport while also reducing the number of missed appointments?

Mississippi has used the same broker for years to facilitate Medicaid transportation, but the vast majority of Medicaid recipients are not using the service. The current arrangement may be saving some money over more traditional options, but the real question is whether mobile app technology now affords a much better and cheaper way to provide transport.

Thanks to a 2017 rule change by the Trump administration, healthcare providers are allowed to provide free or low-cost transportation services to patients. The administration is also looking at an additional rule change that would provide more flexibility in this area. An obvious solution is to use ridesharing services, like Veyo, Uber Health and Lyft, to lower costs.

Ridesharing is commonplace all across America. It works by allowing qualified drivers to use their own vehicle to transport other people. As in many other areas, the public health insurance system – Medicaid and Medicare – has yet to really catch on. But ridesharing is an innovative way of harnessing technology.

A recent study in the American Journal of Public Health estimates that adopting a ridesharing model would generate $537 million in total Medicaid savings, with an average annual savings of $268 per user. The authors also conclude that ridesharing could improve the patient experience by allowing for “on-demand scheduling, electronic records for monitoring, more-direct routes, greater reliability, and operational simplicity.”

Last year, Arizona became the first state to use ridesharing for non-emergency Medicaid transport. Multiple states have followed suit, including Florida, Georgia, Missouri, Tennessee, and Texas. A 2018 PEER report likewise recommends that the Mississippi Division of Medicaid explore ridesharing options. A conservative estimate is that Mississippi Medicaid could save millions annually from ridesharing.

At a minimum, early evidence suggests that ridesharing results in fewer missed appointments and reduced waiting times, saving money for hospitals and other providers and increasing patient satisfaction. In addition, it is less expensive than traditional transportation models and costs less per trip on average.

Another opportunity that has arisen since the 2017 Trump rule change is that nonprofit hospitals are offering no-cost transportation using ridesharing services. This service is being provided as part of each hospital’s mandated “community-benefit” requirement. Under federal and state laws, nonprofit hospitals receive billions of dollars in tax breaks in exchange for providing some kind of “community benefit,” a loophole that seems to be more of an accounting gimmick than a concrete form of help to those who most need it. Allowing ridesharing to count toward a hospital’s community-benefit activities at least provides some savings to taxpayers while affording more reliable transportation for Medicaid recipients.

Josh Komenda, the president of Veyo, observed that “there's been a huge opportunity to further develop much more modern technologies, automation, and tracking…Think about all the technologies that have been invented: cloud-based technology, mobile technology, GPS tracking, web portals, and mobile apps. These are ways that we have basically built a new management system.”

These technological innovations are revolutionizing the non-emergency medical transportation industry. For instance, legacy medical transport vendors have higher costs and less flexibility because they must maintain and house a fleet of vehicles. Ridesharing avoids this expense and can adapt more easily to spikes in unexpected demand. Ridesharing also employs the latest tracking and monitoring software in order to keep patients safe and reduce waste, fraud and abuse.

In an era of budget cuts where lawmakers are forced to prioritize services and look for more efficient ways of doing things, they should consider that other states are saving money and boosting patient satisfaction by adopting a ridesharing model for Medicaid transport. Consumer-driven and consumer-friendly technological innovations are saving taxpayers millions of dollars every year.

Why should Medicaid patients – and Mississippi taxpayers – miss out?

This column appeared in the Northside Sun.

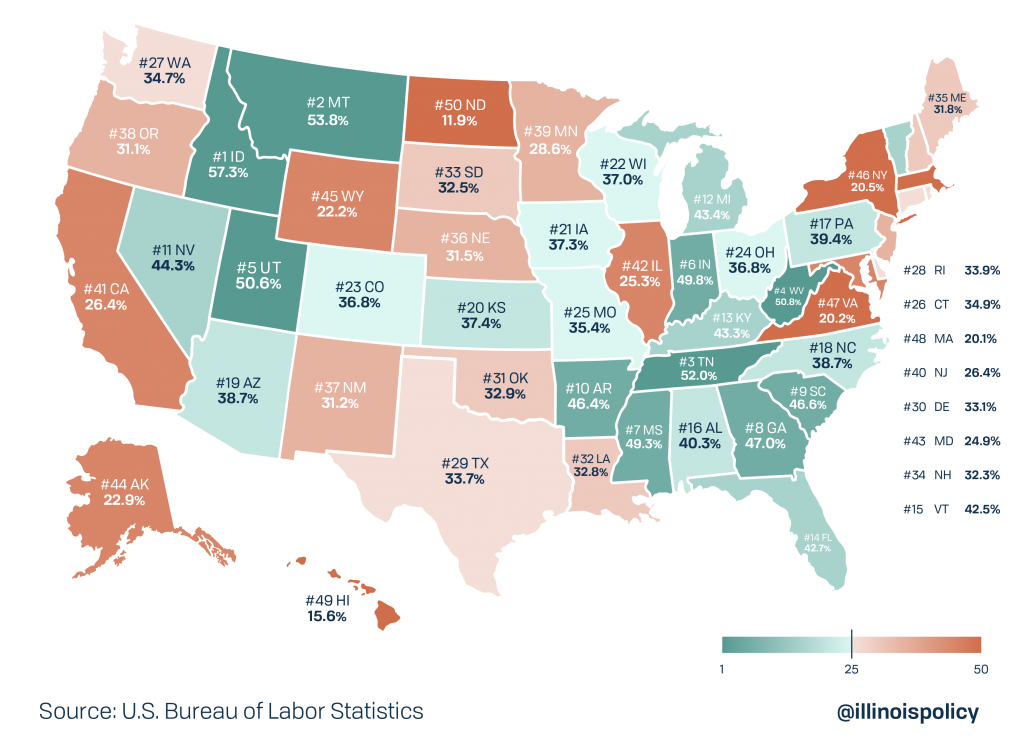

Mississippi is doing better than most states when it comes to recovering from the economic shutdowns caused by the coronavirus pandemic.

Mississippi’s unemployment rate, which was the highest in the nation at 5.4 percent one year ago, is now more middle-of-the-pack at 8.7 percent. This is down from 10.5 percent in May, and better than the national average of 11.1 percent.

Notably, the increase of just 3.3 percent over the past year is one the lowest jumps in the country. That contrasts with the state’s that were at the center of the COVID-19 pandemic in the spring, including Illinois, Massachusetts, Michigan, New Jersey, and New York. They subsequently made the most draconian moves to shut down businesses and they have seen their unemployment rates jump by 10.6 to 14.5 percent since last June.

Mississippi's relatively low unemployment rate is due to the fact that Mississippi is doing better than most when it comes to the state’s jobs rebound.

February-April job losses that returned in May and June

Almost half of the jobs that were lost from February through April have returned in May and June in Mississippi. The South has been stronger than most other regions of the country, and Mississippi’s rebound of more than 49 percent is seventh best in the nation.

Neighboring Tennessee came in slightly ahead at 52 percent, placing the Volunteer State third nationally. Louisiana, which has seen a rebound of just 32.8 percent of jobs lost, is the only state in the Southeast not in the top half of the recovery.

Still, we know the recovery hasn’t been even, and many businesses – particularly small businesses – continue to struggle. Especially when promised relief funds never show up.

“They promised us all kinds of grants and loans," said Edward Ferrell, owner of the Little Yazoo Sports Bar and Grill in Yazoo City. "Nothing’s happened. I have not received a dime of that money. I’ve had to let good friends go who had worked for me for the last five years because I can’t afford to pay them. I can’t afford to pay the bills. I’m dipping into my savings that we were going to use to update the bar. We can’t do it now.”

That is why the continued focus on the use of federal funds for the recovery efforts in the state should be on private sector needs, not public sector wants.

As Mississippi marks the 54th anniversary of legal liquor sales in the state, the state run liquor warehouse is still not able to meet consumer demand.

In a recent story from WLBT, local liquor store owners are complaining that liquor shipment are still delayed at least two weeks. There was a run on liquor at the beginning of the pandemic, but that has eased off. Sean Summers, owner of Calistoga Wine and Spirits in Ridgeland, said his business is down 50 percent since December.

Yet, Alcohol Beverage Control is unable to complete basic orders. This raises numerous questions, such as, why do we need the state to control alcohol?

But what makes the recent news about shortages more ironic is that yesterday marked the 54th anniversary of the first legal liquor store in the state. On that day, Jigger and Jug opened in Greenville. That happened more than 30 years after the federal government repealed prohibition.

Mississippi has a long history of attempting to control alcohol consumption. It was the first state to pass some form of prohibition in 1908, and then was the first state to ratify the 18th amendment, creating a federal prohibition in 1918.

While prohibition inspired some great blues songs and classic literary characters it was bad public policy. For years before 1966, many establishments openly sold alcohol to customers, and the state even placed a 10 percent tax on the sale of alcohol, essentially making a mockery of its own prohibition laws.

Public policy ought to be rational and easily comprehendible by the public. Our modern laws governing the control of alcohol are anything but that, and continue a long tradition of excess government control.

We have over empowered individual counties to define their own laws, and in so doing have created a chaotic state of regulation, difficult to understand by the average residential citizen, let alone internal and external businesses hoping to sell. Though residents in dry counties or those passing through will soon be allowed to legally posses alcohol.

Furthermore, the state has retained an egregious amount of control of the distribution process. Mississippi has decided that, rather than allow private businesses to control the market, it will run a large warehouse in the central part of the state which will have a complete monopoly over the distribution of all spirits and wines.

As the Department of Revenue states on its own site, “the ABC imports, stores, and sells 2,850,000 cases of spirits and wines annually from its 211,000 square foot warehouse located in South Madison County Industrial Park.”

This warehouse consistently operates at capacity, and government leaders are considering a $35 million expansion. Perhaps our politicians ought to consider giving the free market a chance?

There is no reason that our government should be so deeply involved in controlling the distribution for a product. They hike up prices by a tremendous rate, limit access to the product, and determine which brands are allowed to sell in the state, leaving businesses in the dark and unable to control their own wares.

Private businesses are barred from distributing alcohol in Mississippi. While UberEats, DoorDash, and GrubHub have created thousands of jobs in other states through their delivery systems, our legislative leaders have shut down this opportunity for individuals to order alcohol with their delivery.

And while a variety of companies sell and ship wine, whiskey, and other alcoholic beverages around the country, our legislative leaders have determined that we shouldn’t have this freedom of access.

The excess regulation has made Mississippi last in the nation for craft beer development. For comparison, craft brewers currently produce $150 per capita in Mississippi, while they produce $650 per capita in Vermont. Imagine the difference such an industry could make in our state. This is thousands of tangible new jobs which are being discouraged from coming into existence by our government.

Existing policies have led Mississippi to have the largest shadow economy in the nation (referring to the exchange of products that are not taxed or recorded) at 9.54 percent of GDP. Moonshine is either produced or is available in every single county, which many link to the strict regulation of the alcohol industry. Our egregious taxation of alcohol products displayed here by the Department of Revenue has encouraged many companies such as Costco and Trader Joes to avoid opening locations in the state due to the lack of revenue potential on alcoholic products.

Prohibition is alive and well in Mississippi. Our government has decided we apparently can’t be trusted to make basic purchasing decisions for ourselves, so they must control what alcoholic drinks we’re allowed to have access to, how we’re allowed to receive these drinks, and from whom we’re allowed to purchase these drinks.

Be not fooled by the government “do gooders” who proclaim that they carry out policies like this for our own protection. Too many of our political leaders refuse to give freedom a chance, and instead have decided that they know better than we do when it comes to running our lives.

The fact is that while Mississippi prides itself on having a relatively low income tax, it finds dozens of other ways to tax and control its citizens.

Companies are discouraged from entering into business in the state because we have established covert taxes which discourage entrepreneurial risk taking.

Mississippi controls, regulates, and taxes alcohol worse than New York or California, so imagine what other discrete ways it is shutting down job opportunities and discouraging new business.

For now, the premise is simple: Get the state out of the alcohol business. Alcohol sales shouldn't be another excuse to take from taxpayers. That is not the role of government. Instead, Mississippi leaders should trust in the free market.

“The government shutdown pretty much devastated my business. Today, my business is in financial jeopardy.”

Edward Ferrell and his wife Kristi own Little Yazoo Sports Bar and Grill on Highway 49 in Yazoo City. They purchased it in 2014 when the opportunity occurred.

“It’s always been a bar here,” Ferrell said. “It’s always been lucrative, so we took a chance on it. We’ve owned it for the last six years, and every year we stayed in the black until this year when they decided we needed to shut down for the COVID 19 outbreak.”

Back in March, the bar was forced to shut down by the state. As opposed to restaurants that could hang on by offering curbside or take out, they couldn’t. The bar would stay locked down for more than two months.

“They promised us all kinds of grants and loans. Nothing’s happened. I have not received a dime of that money. I’ve had to let good friends go who had worked for me for the last five years because I can’t afford to pay them. I can’t afford to pay the bills. I’m dipping into my savings that we were going to use to update the bar. We can’t do it now.”

Today, Ferrell has to use his income from his other job to pay the bills at the bar because they aren’t making the money needed to cover costs.

Because even though bars are limited to 50 percent capacity, it doesn’t mean bills have been cut in half.

“My bills are not 50 percent. I still have to pay the same amount of rent, same amount of lights, same amount of water, same amount of insurance. I try to make a dollar for myself, and there’s just no way to do that. We had a full-time kitchen. Now we can’t afford to pay a cook, so we had to shut the kitchen down. You can’t order half stock, you have to order full stock, and you’re going to lose half of it because you’re not selling it. They don’t split the packages in half because were at 50 percent.

“We’re limited to 50 percent, but it took 90 percent at full capacity just to pay the bills.”

To the Ferrell’s, and those that frequent the bar, it’s more than a place to get a drink.

“We firmly believe in giving back to our community. Every year we hold a womanless beauty pageant. We take that money raised, and we take care of the DHS foster kids. Anytime someone comes down with cancer, a friend of ours, a patron of our bar, we jump in and do benefits for them, we raise money to help them. We recently had a nurse who had to have emergency surgery, and she’s out for eight weeks. We did a plate cooking here and raised a lot of money that’s going to help pay her bills while she’s out.”

“We love them, they’re family, we’re all family.”

And so, Edward and Kristi will keep fighting. Even at 50 percent.