Mississippi has some of the most consumer friendly laws in the country when it comes to buying and using fireworks.

You have probably noticed temporary firework stands set up near your house in the past couple weeks and that is because Mississippi has a defined selling period. Retailers can sell fireworks during the two busiest seasons; from June 15 through July 5 and from December 5 through January 2. And what retailers can sell and you can purchase is largely wide open.

But while state law provides for much freedom, many municipalities limit the use of fireworks in their city limits. Though not exhaustive, here is the rundown of whether fireworks are legal or illegal in Mississippi cities.

Fireworks are legal in the following cities:

Bay St. Louis, Horn Lake, Jackson (as of 2011), Natchez, Nettleton, Waveland.

The use of fireworks are banned in the following cities:

Aberdeen, Amory, Biloxi, Columbus, Corinth, D’Iberville, Diamondhead, Fulton, Hattiesburg, Hernando, Laurel, Long Beach, Meridian, Moss Point, Ocean Springs, Olive Branch, Oxford, Pascagoula, Pass Christian, Petal, Poplarville, Ridgeland, Southaven, Starkville, Tupelo, Vicksburg, West Point.

Disclosure: These regulations are based on recent news stories. Check with local authorities for most updated ordinance.

The default appears to be illegal, while it is largely legal in unincorporated portions of the counties.

One of the most common refrains from limiting fireworks is safety concerns and injuries caused by fireworks. But a 2017 report from the U.S. Consumer Safety Commission says “there is not a statistically significant trend in estimated emergency department-treated, fireworks-related injuries from 2002 to 2017.”

Rest assured, you are more likely to get injured from children’s toys then from fireworks-related injuries.

Noise is the other big complaint concerning fireworks, particularly after a certain time. Of course, municipal noise ordinances can and already do police that issue.

So as you celebrate the day which marks our freedom from the tyranny and oppression of another country, make sure you don’t run afoul with our own government regulators that have taken it upon themselves to limit your freedoms.

In December, Andrea Falcetto attended Mississippi Host Club conference as an Airbnb host. There, she learned that between 2017 and 2018, Mississippi Airbnb hosts earned a combined income of $7.2 million dollars while $1 million dollars was earned in taxes which then went to state and local government.

But more than that, 1,800 guests were welcomed to the state of Mississippi by local Airbnb hosts alone.

Andrea experience as an Airbnb host started five years ago. In those five years, she has hosted over 500 people herself from various walks of life, including interns, doctors from Canada, people doing tours of the South, and some visiting from Chicago on spring break.

Andrea’s own first stay at Airbnb was back in 2013 in Memphis when she was visiting from Kentucky. After numerous personal experiences like this, she realized how easy it would be to host her own Airbnb space.

In her move to Louisiana from Kentucky, Andrea had Airbnb in mind and settled on a house with extra bedrooms. She found one and rented out through Airbnb for the two years she lived there. When she moved to Jackson in 2017, she did the same thing and found a three-bedroom house, two of which she currently rents out.

Now, thanks to the constant bookings, she rarely gets a single night in her own home to herself.

But Andrea does not mind sharing her home. She sees it as an investment, putting the income made from renting back into the historic house in Fondren she lives in. Ultimately, the fact she is providing a spot to stay for someone who needs a place to stay, and in turn, she then has the ability to work on some projects for her home. provides a win for everyone involved.

Andrea believes Airbnb is important to Jackson but especially the Fondren area. Right now, though there are hotels being constructed now, there are currently no hotels in Fondren and those who come visit want to experience that local city feel.

The only way for them to do that right now is to stay in an Airbnb unit. Even after those hotels are built however, Airbnb will still be a more economical option for many.

As long as it has that appeal, Airbnb will continue to provide an additional form of income for local hosts in Jackson and bring to the area millions of dollars in tax revenue a year.

One of the arguments against charter schools in the case before state Supreme Court is that they take away local property tax revenue from the Jackson Public School District.

The amount provided to the charter public schools in Jackson is minuscule when compared to both the amount of local property tax revenue (slightly more than 1 percent) and the annual expenditures by JPS (less than 0.5 percent).

Since 2015, the three charters located in Jackson have received $4.5 million from the district’s property tax revenue, or about 1.2 percent of the $373,917,333 in property tax revenue the district has received during the same span.

| Year | Revenue |

| 2018 | $94,083,314 |

| 2017 | $95,357,603 |

| 2016 | $92,465,330 |

| 2015 | $92,011,086 |

In 2018, JPS had expenses of $277,820,379, $298,256,286 in 2017, $282,231,492 in 2016 and $268,687,636 in 2015.

That adds up to $1,126,995,793 in expenses from 2018 to 2015. The amount directed to charter schools represents only 0.4 percent of that spending.

The arguments Tuesday before the state Supreme Court arose because of a 2016 lawsuit by the Southern Poverty Law Center that questioned the validity of the state’s 2013 charter school law and whether local property tax revenues can be used to fund public charter schools.

A February 2018 ruling in Hinds County Chancery Court was a victory for charter school supporters, but the SPLC immediately appealed to the state’s highest court.

The reason for the location of charters in Jackson is because the district is a failing one according to the Mississippi Department of Education’s annual accountability scores. The district has received an F grade for the past three years.

Since 2011 when the MDE switched to a letter grade system for its accountability scores, JPS has scored no higher than a D.

The accountability grades are partially based on the performance of students and the annual progress made on the Mississippi Academic Assessment Program tests for English language arts and mathematics, which are administered annually to students in the third through eighth grades and in high school.

Also figured into the accountability grades are the four-year graduation rate, student performance on biology, U.S. history and ACT tests, and student participation and performance in advanced coursework such as Advanced Placement.

A finalized rule unveiled last week by the Trump Administration could help make coverage both more portable and affordable and increase choices for consumers.

The new rule deals with Health Reimbursement Arrangements or HRAs, which are employer-funded accounts that workers use to pay for health insurance premiums or medical expenses.

This rule will allow employers to offer HRAs to their employees in lieu of a company sponsored plan. These plans would allow an employee to take their coverage with them rather than the plan being owned by their employer and leftover funds would roll over from year to year.

According to the Department of Health and Human Services, the expansion of HRAs would benefit approximately 800,000 employers and 11 million employees and family members, including an estimated 800,000 who were previously uninsured.

It would also free small businesses from the complexity of having to manage a company-provided plan for its employees.

“Too many Americans today have little say in how their healthcare is financed,” said HHS Secretary Alex Azar in a statement. “President Trump has promised Americans that he will put them in control of their healthcare, and this expansion of health reimbursement arrangements will help deliver on that promise by providing Americans with more options that better meet their needs.

“This rule and other administration efforts are projected to provide almost 2 million more Americans with health insurance.”

White House economist Brian Blase told reporters on a conference call that the vast majority of expansion under the new rule will be on plans that are not part of the Affordable Care Act’s plan exchanges. He also said that the new rule will require employers to either offer a sponsored plan or migrate to the HRA model.

Under the new rule which takes effect on January 2020, companies can replace their sponsored plans with the HRAs to allow their employees to purchase in the individual market. Employee and employer contributions to HRAs are without tax penalties when it comes to both income and payroll taxes, like employer-sponsored health plans.

According to the HHS, 80 percent of employers that provide coverage only offer one plan.

In 2017, President Trump issued an executive order that says the administration will prioritize three areas for improvement: Association Health Plans, short-term, limited duration insurance and HRAs.

Short-term insurance plans are ones that aren’t compliant with the massive tome of rules and regulations that made Affordable Care Act plans unaffordable to many consumers and the Trump administration’s rule allowed more customers to

The other rule allowed small businesses to join Association Health plans and receive savings through economies of scale once only limited to large companies.

Technology, creative disruption, and capitalism continue to work together to make our lives better and easier. Though there is often a desire by government to limit the full potential of new technology.

Having a personal shopper or getting fine dining delivered straight to your doorstep aren’t just luxuries for the ultra-rich these days. Now they’re available in a single click as mobile delivery apps continue to expand in their creativity and their delivery.

While these services may feel common in today’s society, they would have seemed otherworldly just 10 years ago. Instead of spending hours grocery shopping, you can have your groceries delivered to your front door, fine dining with the convenience of take out, and cheap rides on demand around the clock - leaving those who commute to work a less expensive alternative and those who drink and drive no excuse.

If you felt so inclined to take advantage of these conveniences, all you would have to do is place an order with any one of the dozens of delivery services available on the App Store,. Yet in Mississippi there may be something missing from your order – an adult beverage of your choosing.

That is because Mississippi has a prohibition on the delivery of alcohol with your meal. You can order that adult beverage if you sit down at the restaurant and eat. But when you order that same meal from the same restaurant via an app, that same drink cannot be included.

Mississippi is part of an ever-shrinking pool of states with such a policy. Last week, Texas Gov. Greg Abbott signed into law a bill legalizing home delivery of alcohol with your meal. And in doing away with outdated regulations, Texas sets a good example for Mississippi to follow.

Home delivery is about more than just drinking, it’s about the completion of an experience created by the free market. Customers benefit from being able to enjoy a drink with dinner or by saving another trip to the grocery store. Employees and employers benefit by an expanded consumer base, thus creating higher wages as well as new jobs. And the state benefits by introducing new revenue without the increase of taxes.

While they say everything’s always bigger in Texas, these benefits would make a pretty big impact right here in Mississippi, for the state and for the individual.

The technology is available. Convenience could be just a click away. If the government would let consumers choose.

Everyone knows too well that gut punch when you receive a bill in the mail from a provider only to realize insurance has already been applied. Health care is expensive. We need a system that is firmly rooted in competition and market dynamics.

President Trump made lowering drug prices a campaign promise. To his credit, the president is working to address this issue. That’s why he tasked the Department of Health and Human Service Secretary Alex Azar to come up with a solution to address rising drug prices. We applaud this move by the President and support their objective of lower drug prices.

Unfortunately, Secretary Azar’s proposal to lower drug costs has an alarming feature — an “International Pricing Index” or IPI. This index would serve as a price control mechanism for Medicare Part B drugs sold in America. Part B drugs are the kind that are administered by a doctor usually as injections or infusions such as chemotherapy drugs, unlike the ones that are bought at a pharmacy and taken at home.

Alarmingly, the IPI would look at the prices of drugs in 14 foreign countries and use them as a base in the U.S. Many of these countries have socialized or government-controlled healthcare industries, and should not be looked to as an example for our own healthcare.

One of the reasons America is seen as the world leader in healthcare is the vast number of new drugs that are produced here. Because of our free market system, drug manufacturers can compete with one another to produce the best, most effective medicines in the world. Millions of patients all across the globe have benefited from a system of open competition that has led to the development of the majority of new drugs over the last several years.

However, the IPI could change all of that. Using artificial price controls could cut the legs out from under drug manufacturers and inhibit their ability to develop new, life-saving medicines. Producing a new drug is extremely expensive, sometimes costing as much as $2.6 billion for a single drug, according to Policy & Medicine. This is due to the high failure rate among experimental drugs, with 90 percent failing to gain FDA approval on average, according to BIO.

While the price of developing these drugs is high, it is necessary. Each new drug that makes its way to market has the potential to change millions of lives for the better. The IPI could be the start in taking that opportunity away from patients across the world.

Though the current proposal only applies to Medicare Part B drugs, if implemented, the IPI and other similar price control methods could quickly and easily spread to other areas of our healthcare system, and even to other industries. Socialism creeping into our economic model is dangerous. It does not work. It can sound good to certain segments of our population, but it has never worked. Wherever and whenever socialism has been tried, it has failed and humans have suffered by the millions. Competition and free markets do work and have made the United States the strongest economy in the world.

A better proposal was introduced in Congress that would lower prices for Medicare Part D drugs. The Medicare Part D Rebate Rule, as it is being referred to, would use free market solutions to lower drug prices instead of socialist price control measures. The rule would take the savings created through open negotiations between insurance plans and drug makers and pass those savings onto the sickest of seniors – not the middlemen who have historically pocketed the savings themselves.

Washington is doing the right thing by focusing on reducing drug prices and making healthcare access more affordable for patients all across the country. However, it is important that they remember to stick to using free-market solutions — like the Part D Rebate Rule — to accomplish this goal and stay away from using socialist price control mechanisms like the IPI.

This column appeared in the Clarion Ledger on June 12, 2019.

The Mississippi legislature this year reauthorized part of the Mississippi film incentive program that they let expire just a couple years ago.

Senate Bill 2603, which Gov. Phil Bryant signed in April, will bring back the non-resident payroll portion of the incentives program. This allows for a 25 percent rebate on payroll paid to cast and crew members who are not Mississippi residents. It expired in 2017 and the Senate had refused to consider it. Until this year.

Two other incentive programs have remained on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

Film production companies, naturally, are excited. After all, they are the only winners in the race to the bottom known as film incentives.

“That bill effectively makes Mississippi as competitive as virtually any other Southern state from a production perspective in terms of movie producers trying to find places that they can most affordably come to make movies,” said Thor Juell, vice president of Village Studios and Dunleith Studios. “That is a big deal in terms of our ability to drive the economy of production and movie film making to Mississippi, and more specifically to Natchez. That is a big deal and that is effectively why I am here.

“I had previously been working in Louisiana,” Juell added, “and Louisiana has obviously had a long history of tax incentives there that have made them extremely competitive, and they’ve seen massive spikes in jobs and just the general outlying economic activity related to all the impending pieces. Mississippi, in my opinion, is even better.”

Better for some people, but not taxpayers

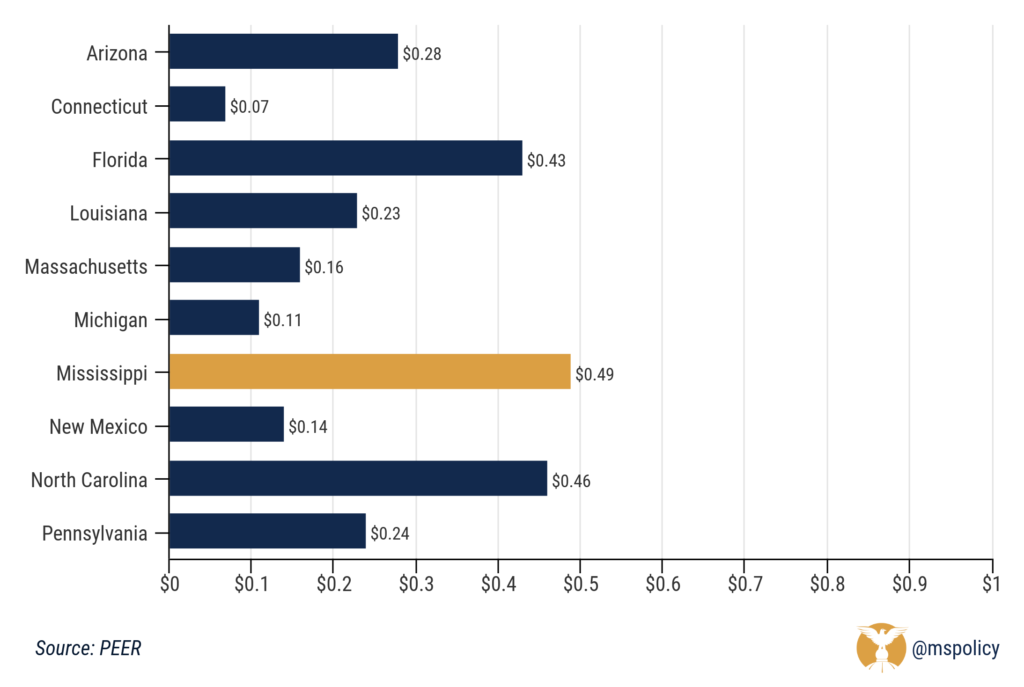

A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return. If you or I were receiving that return on our personal investments, we would fire our financial advisor. Of course, no one spends his or her own money as carefully as the person to whom that money belongs.

For those looking at a bright side, we are actually “doing better” than many other states. This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, but either way it’s a terrible investment.)

Beyond Mississippi and Louisiana, film incentives are a poor investment throughout the country. Numerous studies have been conducted on film incentives. All sobering for those worried about taxpayer protection. Here is a review of the return per tax dollar given, courtesy of the PEER report.

That is why the number of states offering film incentives is diminishing. Not in Mississippi though.

No one can blame Juell or anyone else in the film industry for wanting or taking advantage of incentives. They are in business to make money. Yet, the state shouldn’t allow them to do so at the expense of taxpayers. Rather, the state should be working to reduce the tax burden on all companies, regardless of whether or not they have lobbyists in Jackson.

Revenue from sports betting dropped considerably in April after March Madness provided a boost last month.

Taxable revenue was just over $2 million in April as we enter a slow season for sports betting before football returns this fall. In March, revenues were just under $4.9 million, a far outlier from recent trends, thanks to the college basketball tournament. January and February hovered between $2.7 and $2.8 million.

Mississippi was the first state in the Southeastern Conference footprint to have legal sports betting after the Supreme Court overturned the federal ban, but neighbors are beginning to enter the sports betting world as well.

Louisiana is debating an on-again, off-again, and for right now, back on-again, sports betting legalization in casinos. While it’s a far ways from becoming law, this would have the biggest impact on Gulf Coast casinos, which provide a little more than half of the revenue for sports betting in Mississippi. For Mississippi’s Gulf Coast boosters, they have to be hoping this bill doesn’t make it across the finish line.

But the future of sports betting, if states want to increase tax revenue, appears to be online according to a new report from the Tax Policy Center, which has analyzed the first year of legal sports betting in the United States.

“As New Jersey demonstrated, allowing mobile sports betting in addition to in-person betting can exponentially increase tax revenue from sports gambling. Nevada and New Jersey were the only states to collect over $20 million in tax revenue over the past year from sports betting, and they are also the only states that offered online wagering throughout their states,” the Tax Policy Center writes.

Our neighbor to the north, Tennessee, has taken that approach by legalizing online sports betting. Unlike Mississippi and Louisiana, the Volunteer State does not have casinos. Therefore, those interested in betting on a sporting event will be able to do so from their smartphone or computer.

Betting in a casino may be attractive for a destination event such as the Super Bowl or a major boxing match, but it’s likely not going to happen for an average basketball or baseball wager on a Tuesday night. That person will continue to use an illegal, offshore website, which costs the state revenue it would otherwise receive.

And until Mississippi permits online betting, it will continue to lose that revenue.

A Mississippi shipyard that is receiving a $745 million contract from the federal government for a new class of three U.S. Coast Guard heavy icebreakers will be receiving $14 million in state incentives.

VT Halter Marine in Pascagoula will receive $12.5 million for a new drydock and $1.5 million for workforce training, according to the Mississippi Development Authority. The company says it’ll add about 900 workers and that adds up to about $15,555 per job.

The contract for engineering and design costs of the new icebreakers, along with long-lead time materials and construction costs was awarded on April 23. Construction on the first of three heavy icebreakers is scheduled to begin in 2021, with delivery on the first ship planned for 2024. If all of the options in the contract are realized, it could add up to $1.9 billion.

The icebreakers are desperately needed, as the Coast Guard’s lone remaining heavy icebreaker, the USCGC Polar Star, is overdue for replacement and is dealing with serious mechanical difficulties. The Coast Guard also has a medium icebreaker, the USCG Healy, that isn’t as capable an icebreaker as the Polar Star.

VT Halter has built most of the National Oceanic and Atmospheric Administration’s fleet of research ships, missile boats for the Egyptian Navy, towed sonar array ships and accommodation barges for the U.S. Navy and landing ships for the U.S. Army.

VT Halter isn’t the only Mississippi shipyard receiving a handout from taxpayers despite lucrative U.S. Navy and Coast Guard contracts.

Since 2004, Huntington Ingalls Industries has received $307 million from state bonds to help fund improvements at its Pascagoula shipyard, which is one of the state’s largest employers with 11,000 workers and a construction contract backlog with the U.S. Navy and Coast Guard of $12.37 billion.

The company will receive another $45 million after the Legislature approved a payment in this year’s session.

The company received $45 million in 2017, $45 million in 2016 from state taxpayers, $20 million in 2015, $56 million in 2008, $56 million in 2005 and $40 million in 2004.

The Pascagoula yard builds the America and San Antonio classes of amphibious warfare ships, the Arleigh Burke class destroyers and the Coast Guard’s National Security Cutter, the Bertholf class.