There was a time when most states had some kind of incentives for the film industry, but that trend has quickly changed. While 44 states had incentives a decade ago, today just 31 do. Others, like Mississippi, have quietly scaled back their program.

For the past two sessions, the Senate has killed attempts from lawmakers in the House to extend the non-resident payroll portion of the incentives program. This previously allowed for a 25 percent rebate on payroll paid to cast and crew members who are not Mississippi residents.

Two incentives remain on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

House Bill 1128 would bring back the non-resident rebate. Lawmakers should proceed with caution.

A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return. If you or I were receiving that return on our personal investments, we would fire our financial advisor. Of course, no one spends his or her own money as carefully as the person to whom that money belongs.

For those looking at a bright side, we are actually “doing better” than many other states. This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, but either way it’s a terrible investment.)

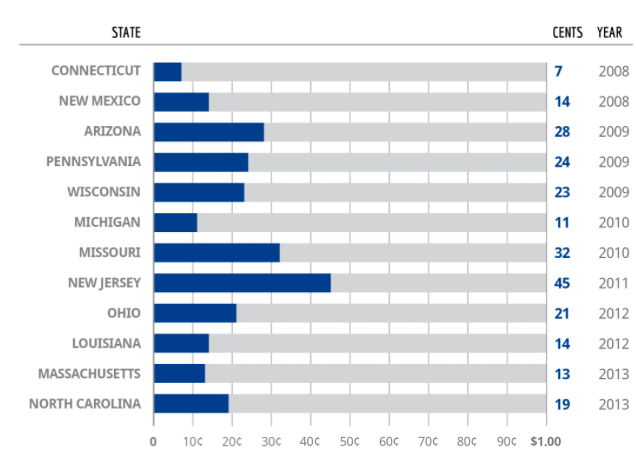

Beyond Mississippi and Louisiana, film incentives are a poor investment throughout the country. Numerous studies have been conducted on film incentives. All sobering for those worried about taxpayer protection. Here is a review of the return per tax dollar given, from 2008 through 2013. In these third-party studies, covering 12 different states, there was not a program that returned even 50 cents on the dollar.

Source: John Locke Foundation

Since this chart was published, studies on similar programs in Florida, Virginia, and West Virginia have shown similar results. No program had a positive ROI.

One of the commonly prescribed reasons for why need film incentives is it’s “good” for the state to have movies filmed here. As is often the case in government, we focus on the inputs. How many films are made here? What movie star was in Mississippi? That is nice, but the focus should be on outcomes.

The other common argument is that other states are doing it. Throughout the country, producers hold states hostage and threaten to move without incentives. Producers in Mississippi have raised the same point. Again, that is not good reason to essentially throw taxpayer money away.

Simply because another state is wasting money does not mean Mississippi should join them, or continue this practice.

In a comprehensive list of state film production incentives compiled by the National Conference of State Legislatures (NCSL), we see states that do not have incentives for producers but offer tax breaks to everyone, without partiality. For example:

Alaska: No film incentive program. Effective July 1, 2015, the film production incentive program was repealed. Alaska has no state sales or income tax.

Delaware: No film incentive program. However, the state does not levy a sales tax.

Florida: This program sunset on June 30, 2016. It has not been renewed. The state does not levy a state income tax.

New Hampshire: No film incentive program. The state has no sales and use, or broad base personal income taxes.

South Dakota: No film incentive program. There is no corporate or personal income tax in South Dakota.

Our goal should be for Mississippi to have the most competitive business climate in the country. The tax breaks that a few chosen industries or companies receive should be made available to all.

When we do that we will remove the need for taxpayer funded incentives.