Senate Bill 2603 allows Mississippi-based motion picture production companies to receive up to $5 million for payroll and fringe benefits paid to out of state, non-resident employees. The bill, as originally written, would’ve provided to out-of-state production companies up to $10 million for payroll and fringe benefits for out of state employees.

This was reduced in conference to $5 million and restricted to production companies that have been certified by the Mississippi Development Authority to have filed income taxes in the state in the past three years and filmed at least two motion pictures in the state in the past 10 years.

The law went into effect immediately and there isn’t a repealer, which means there’s no expiration date on the incentives.

The bill signing marked a major shift in Bryant’s opinion on the motion picture production subsidies, which are being curtailed or eliminated in several other states.

The governor urged the legislature in his FY2018 budget recommendation to allow the Motion Picture Incentive Rebate Program to expire, citing a 2015 report by the Joint Legislative Committee on Performance Evaluation and Expenditure (PEER) as one of the reasons.

“While I support the jobs and attention that films bring to Mississippi, taxpayers should no longer subsidize the motion picture industry at a loss,” Bryant said in his budget recommendation. “The motion picture incentive rebate has cost approximately $25 million since 2011.

“Allowing the motion picture incentive rebate to expire could save a similar amount over the next five years.”

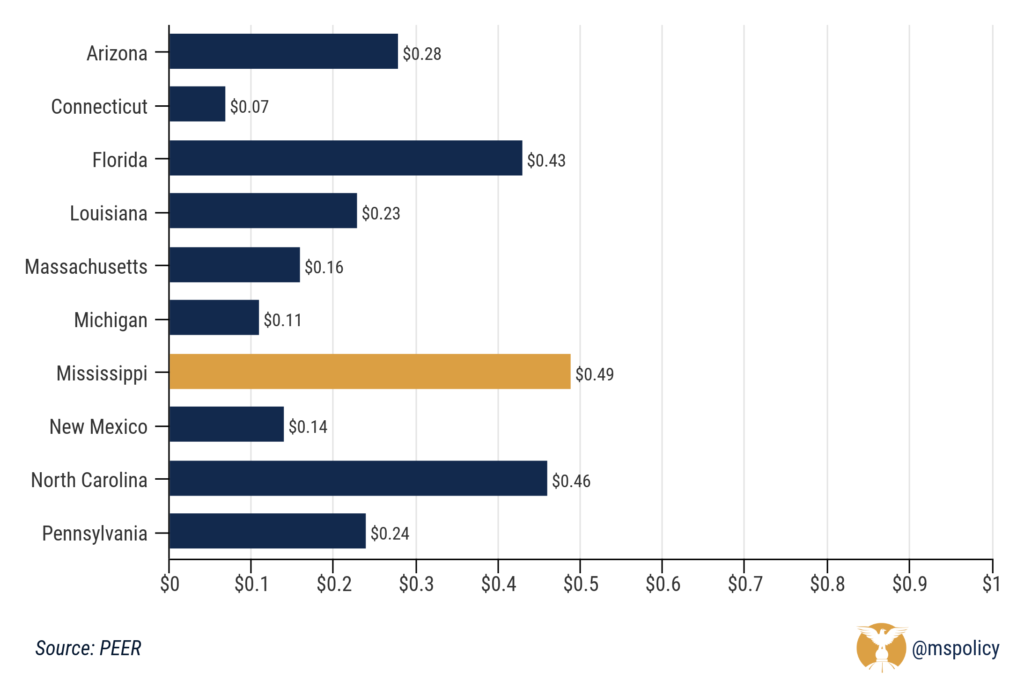

The study showed that the state lost 51 cents on every dollar invested in the program since the program’s enactment in 2004.

Since 2009, according to the National Conference of State Legislatures, 13 states have ended their incentive programs.

There’s plenty of evidence that’s pointing policymakers toward eliminating these subsidies. Indeed, Mississippi’s failure to make a profit on film incentives isn’t surprising. Nor is it out of the ordinary. It’s in line with every other report on incentives, as shown in the graphic below. Film production companies win and taxpayers lose.

A 2016 study by Michael Thom — an assistant professor at the University of Southern California Price School of Public Policy — found that motion picture incentive programs had little to no effect on the economies of the states with the incentives.

Sales and lodging tax waivers had no effect on four different economic indicators, while transferable tax credits — such as the ones in Louisiana — had a small, sustained effect on industry employment levels but no effect on wages.

Refundable tax credits had no employment effect and only a temporary effect on wages.

Mississippi has cash rebate program on eligible expenditures and payroll and provides sales and use tax reductions on eligible purchases and rentals. Rebates are capped at $10 million and the annual rebates provided are capped at $20 million. At least 20 percent of production crew of an eligible production must be Mississippi residents.