Yesterday, both the House and Senate adopted separate legislation that would reinstate the nonresident payroll portion of the incentives program. This would allow for a 25 percent rebate on payroll paid to cast and crew members who are not Mississippi residents.

It was repealed in 2017, when the Senate did not consider renewing it. It is a different story this year.

If the expired incentive is brought back, it would put Mississippi in the position of expanding film incentives program while other states are putting on the breaks. In the past decade, the number of states with such a program has declined from a peak of 44 to 31 (as of last year).

Why are states moving away from film incentives? The answer is simple; the math doesn’t add up.

A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return.

If you’re a proponent of these incentives and you’re looking for a bright side, we are actually “doing better” than many other states. This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, but either way it’s a terrible investment.)

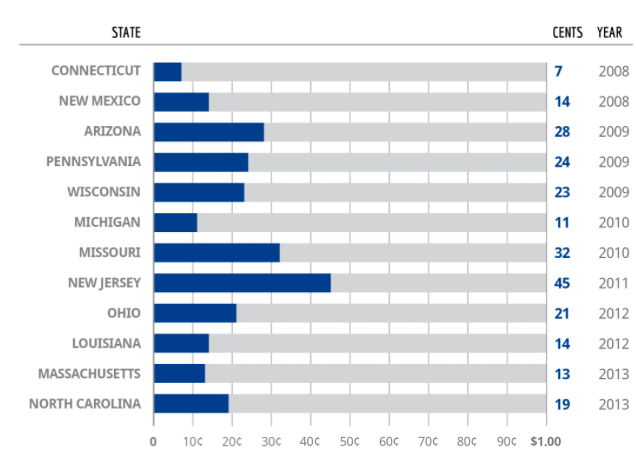

Beyond Mississippi and Louisiana, film incentives are proving to be a poor investment throughout the country. Numerous studies have been conducted on film incentives. Each of them has produced sobering results for those worried about taxpayer protection. Here is a review of the return per tax dollar given, from 2008 through 2013. In these third-party studies, covering 12 different states, there was no program that returned even 50 cents on the dollar.

Source: John Locke Foundation

Since this chart was published, studies on similar programs in Florida, Virginia, and West Virginia have shown similar results. No program had a positive ROI.

Having a movie filmed in your state is a nice trophy, as is having a movie star dining at a local restaurant. But when it comes to our tax dollars, the burden on the state should be to demonstrate how those dollars are being wisely invested.

Other states appear to be focused on results of film incentives. Mississippi, however, appears to be ignoring the data and heading in the opposite direction.