That is according to a new analysis on cigarette smuggling from the Tax Foundation.

Cigarette taxes are one of the easier targets for lawmakers looking for additional revenue as you combine a large network of health advocates pushing for the tax and a shrinking, unsympathetic demographic of smokers.

That is why cigarette taxes have routinely been floated in the legislature since the last increase in 2009. Even though we know the unintended consequences, particularly with a massive hike such as the 221 percent increase that was unsuccessful last year.

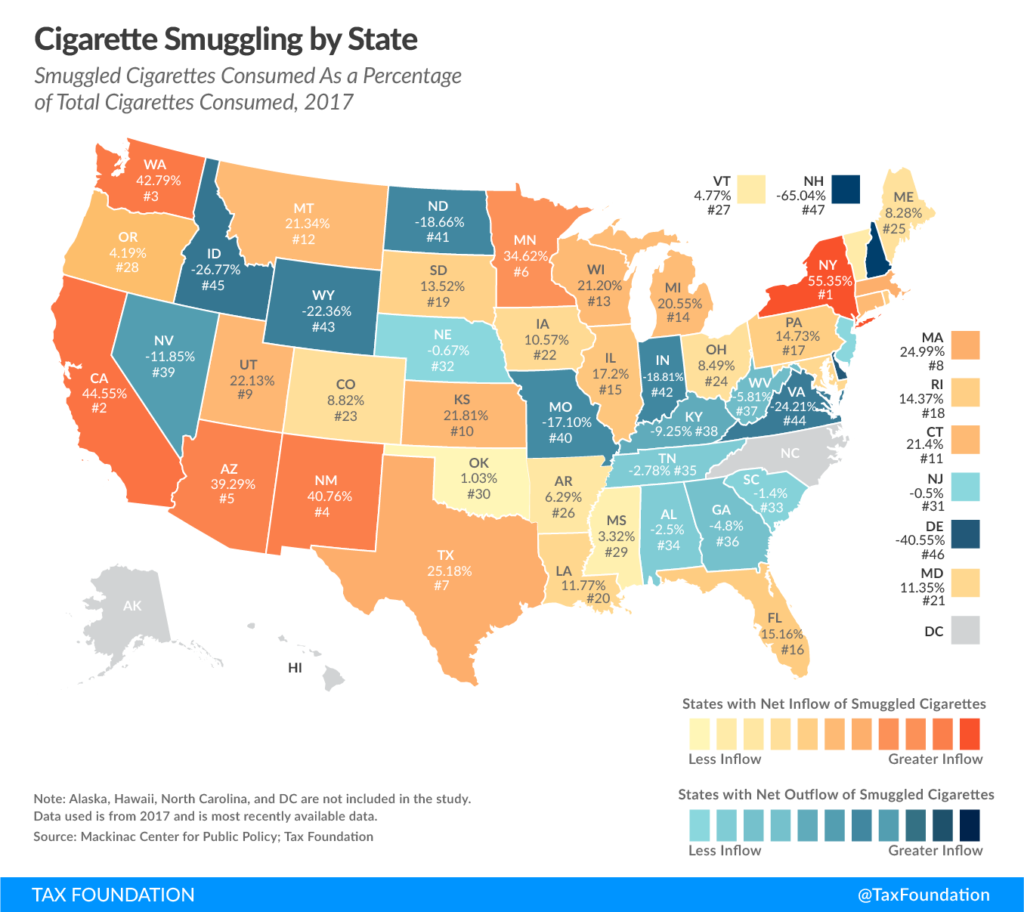

Mississippi has a mild inflow of smuggled cigarettes at 3.32 percent, according to a new analysis from the Mackinac Center for Public Policy and the Tax Foundation. That means for every 100 cigarettes that are consumed in Mississippi, three are smuggled from other states. That is 29th highest in the country.

Mississippi is surrounded by states to the north and east that have lower (though slightly lower in some cases) taxes, including Alabama, Georgia, Kentucky, Missouri, and Tennessee. Each of those states actually have a positive rate of outbound smuggling, ranging from 2.5 percent in Alabama to 17.1 percent in Missouri.

In a review of cigarette smuggling in 2006, prior to the most recent tax hike, Mississippi had a small outbound rate of 1.7 percent.

The estimate is built around a statistical model which measures the difference between smoking rates published by the federal government for each state and legal paid sales. There are often yawning gaps between the two — the amount of cigarettes that should be smoked based on sales and the amount of smoking that actually occurs — and that difference is probably explained by smuggling.

The model can be used to make “what-if” estimates based on proposed changes in tax rates, as compiled by the Mackinac Center last year. At an excise tax of $2.18 per pack, as proposed in 2019, smuggling would leap from the current rate to 35 percent of the total market. That is, of all the cigarettes consumed in Mississippi after such a tax hike, 35 of every 100 cigarettes would be smuggled.

The model also reports that 21 percent of all consumption would be a function of “casual” smuggling. Casual smuggling is represented by individuals who typically buy lower-taxed smokes elsewhere for personal consumption.

The evidence from around the country and elsewhere tells us that relatively high cigarette excise tax rates can produce every sort of mischief, including undermining the very health goals such taxes were adopted to address.