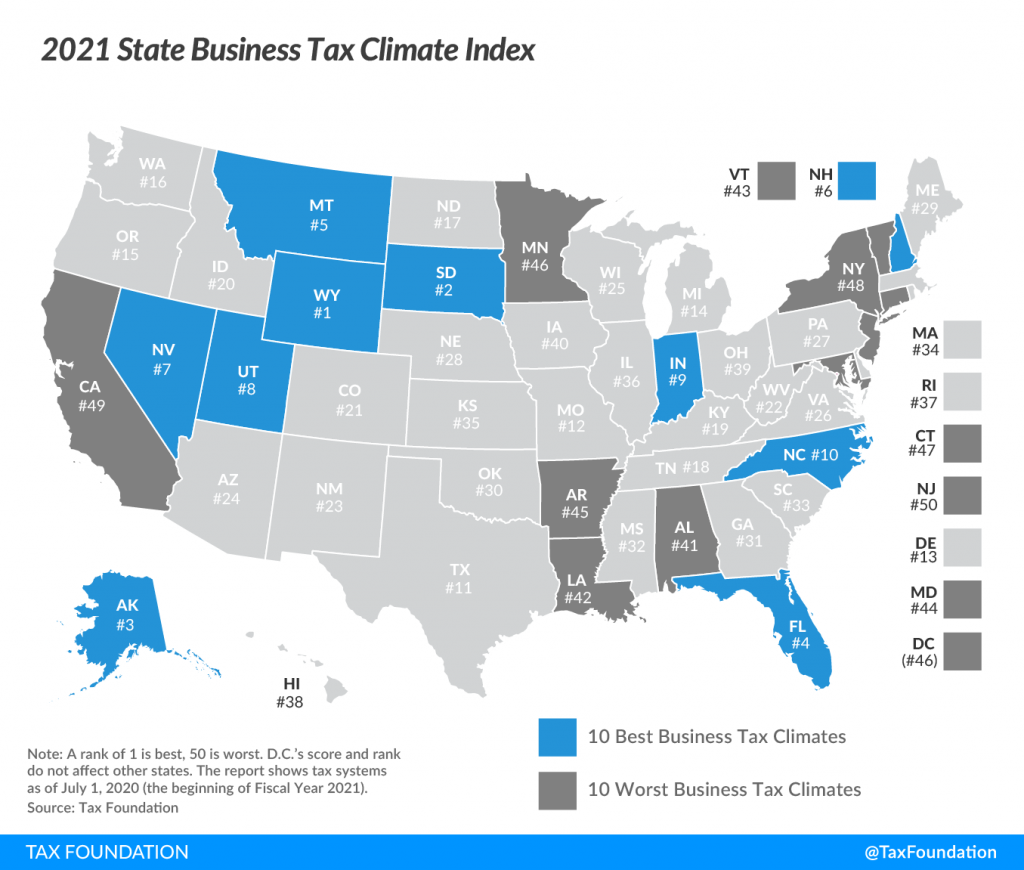

The Tax Foundation placed Mississippi 32nd overall for taxes, including corporate, individual, sales, property, and unemployment insurance taxes. The only neighboring state to do better was Tennessee. Alabama, Louisiana, and Arkansas were rated 41, 42, and 45 respectively.

The top five states remained the same. Wyoming was again the top-rated state, followed by South Dakota, Alaska, Florida, and Montana. Not surprisingly, the bottom five states were New Jersey, California, New York, Connecticut, and Minnesota.

“Business taxes affect business decisions, job creation and retention, plant location, competitiveness, the transparency of the tax system, and the long-term health of a state’s economy,” the report noted. “Most importantly, taxes diminish profits. If taxes take a larger portion of profits, that cost is passed along to either consumers (through higher prices), employees (through lower wages or fewer jobs), or shareholders (through lower dividends or share value), or some combination of the above. Thus, a state with lower tax costs will be more attractive to business investment and more likely to experience economic growth.”

Mississippi dropped a spot from last year, not because the tax climate in Mississippi has worsened, but because other states have improved.

The state received its best marks for unemployment taxes (5th best) and corporate taxes (13th best). The corporate tax component measures impacts of states’ major taxes on business activities, both corporate income and gross receipts taxes. The unemployment insurance tax component measures the impact of state UI tax attributes, from schedules to charging methods, on businesses.

Mississippi’s worst tax categories were property and sales. It would be a good idea to lower our business tax burden on land, buildings, equipment, and inventory.

Mississippi’s business tax climate is part of the reason the state relies so heavily on corporate welfare for enticing businesses. Instead of offering taxpayer incentives or tax abatements to select companies, the state should begin the process of improving the tax climate for all businesses rather than just those who curry political favor.