As America prepares to celebrate a day of Thanksgiving, it is important to look back and consider the lessons of our forefathers. All the way back to its humble beginnings at Plymouth Rock, the American legacy has shined as an example of what freedom and liberty can accomplish.

But in recent years, socialism has been on the rise in America. According to Pew Research, 42 percent of Americans have a positive view of socialism. In addition, the nation has seen increasingly socialistic policies based on the concepts of big government and high taxation. In light of such circumstances, it is important to consider another episode when socialism was in America – and the failure of such socialism.

This story of socialism in America happened with none other than the Pilgrims themselves. When the Pilgrims set sail on the Mayflower, their voyage was financed by a group of investors called the Merchant Adventurers. As a means to pay back the investors, the Pilgrims initially set up a socialistic economy, with a portion of the communal proceeds going back to the investors. However, this system proved to be a failure from the start.

William Bradford, the second governor of Plymouth Colony, described what happened: “The failure of this experiment... [proves] the emptiness of the theory that the taking away of private property, and the possession of it in a community, by a commonwealth, would make a state happy and flourishing; as if they were wiser than God. For in this instance, community of property (so far as it went) was found to breed much confusion and discontent, and retard much employment which would have been to the general benefit and comfort.”

To replace this failed approach, the Pilgrims instituted a system of private ownership, with each family having a farm to call their own. This led to the bountiful successes that culminated in long-term prosperity. Such a failure of socialism, when compared to capitalism, comes as little surprise. The basic principles of individual liberty and personal responsibility will always be more successful than the principles of coercion and a lack of private property.

From Plymouth Rock, all the way to the Soviet Union, socialism has an unbroken record of failure. The successful “American experiment” rejected socialism from its very start, and an embrace of socialism would ultimately spell its end. For the legacy of the Pilgrims and the Founding Fathers to continue, the lessons of history must be heeded and followed. As families gather across the nation to thank God for the blessings of the year and look back on America’s legacy, it is important to ensure that future generations will be able to reap the blessings of freedom. As the rise of socialism seeks to undermine the country's future, a return to America’s foundation just might start by looking back to the lessons of Plymouth Rock.

FOR IMMEDIATE RELEASE

(Jackson, MS): The Mississippi Center for Public Policy today released a policy paper reiterating the case for abolishing the state income tax.

"It's time to give Mississippi a boost and get our state growing," said Douglas Carswell, President & CEO of the Mississippi Center for Public Policy. “Abolishing the state income tax would give every Mississippi worker a pay raise. It would mean they had more money to spend on their priorities and families.”

“With Mississippi’s budget in a record $ 1 billion surplus, now is the time to do it” he went on to explain. “Let’s not wait for politicians to figure out new ways to spend that surplus. Let’s use it to allow workers to keep more of their own earnings.”

MCPP's "Axe the Tax” campaign is set to popularize the argument in favor of giving Mississippi a tax break through the abolishment of the state income tax. The report highlights many key points of the argument, including:

- It would give a major tax break for working families. The median household income in Mississippi is $45,081, and under the current structure, such a household would have to pay approximately $1,600 in state income taxes. The Governor’s executive budget recommendations suggests an individual with a taxable income of $40,000 would be $1,850 better off if income tax was eliminated.

- It would make Mississippi more economically competitive. Neither Florida, Tennessee, nor Texas have state income taxes, and all three have prospered. Mississippi, however, has done less well, decreasing in population and growing less rapidly. Repealing the income tax would assist people with higher and lower incomes in a personal tax break and encourage more private consumer spending.

- It would be great for local entrepreneurs. Mississippi has a long history of giving tax cuts to big corporations. An abolition of the income tax would be a break that helps ordinary businesses – not just those that are well connected in Jackson.

While it failed to pass in the 2021 legislative session, it is likely the issue of income tax abolition will be featured prominently in the 2022 session. MCPP hopes to see cooperation between state leaders ahead of this and offers these recommendations to see a successful process:

- Keep non-income tax rates the same and appropriate the State's $1 billion surplus revenue to reduce the income tax revenues

- Appropriate 50% of budget surpluses to reduce income tax revenues until it has been entirely eliminated

- Place cap on State's general fund budget increases that prohibit increases above 1.5% annually

The Mississippi Center for Public Policy believes repealing the Mississippi income tax would be both a moral and economic good, leading to higher incomes, competitiveness, and prosperity for all Mississippians.

You can read the FULL REPORT HERE.

For media inquiries, please reach out to Stone Clanton, [email protected].

In the quest to expand broadband, some have suggested the implementation of government-owned broadband networks as a way to expand internet access. However, before such proposals are adopted, it is important to consider the key problems with government-owned networks.

In the first place, it is important to define what a government-owned network is (GON). GONs are broadband networks that are owned by a state or local government entity. The government entity usually also handles the operation of the network. Advocates of such networks claim that they help fill in the gaps in private sector service, but it is important to test such claims against the actual track record of the networks.

Mississippi has not seen a widespread implementation of GONs. But the effect of potential future implementation should be considered in light of the experiences of other states. According to a study conducted by the Taxpayers’ Protection Alliance, GONs have a consistent track record of costing more than expected to build and maintain.

Such networks consistently do not reach their targeted populations effectively, with many of them only reaching as little as 40 percent of the targeted households. On top of this, many municipalities have incurred millions of dollars in debt that the broadband networks themselves have not been able to pay for. This has led to higher taxes in some places as municipalities try to recoup their losses.

These facts point back to the principle that government entities interfering in the market by shifting taxpayer funds is an ineffective strategy for broadband. Not only are such programs prone to the problems mentioned above, but there is also the systemic issue with the fact that such government intrusion disincentivizes private sector broadband investment.

While a government network pulls from the flow of taxpayer dollars and lacks real competition, private sector companies have to deal with real challenges in a competitive market. In this way, government broadband has an unfair advantage over private-sector broadband companies. This stagnates private sector broadband investment in these areas and makes the broadband infrastructure expansion the exclusive domain of central government planners. Such centralized planning has a consistent track record of faulty projections and an inability to meet the demands of the market.

In order to prevent such failures, Mississippi should do as other states have done and restrict the formation of government-owned networks. Particularly in the wake of new broadband funding coming into the state, leaders should ensure that government entities do not use the funding to create such networks that will put them into debt and crowd out the private sector.

Mississippi needs real solutions to broadband expansion. While municipal broadband advocates often insist that government-owned networks are a pathway to expansion, empirical evidence and free market principles suggest otherwise. Rather than bring false “solutions” to the broadband gap, Mississippi should pursue free-market models that reject the poor track record of government-owned networks.

Mississippi currently stands as one of the cheapest areas to buy a house. In fact, the state ranks 2nd in the United States in cheap housing at a median value of $144,074 per a typical single-family home. However, that home value only increases at a rate of 9.8%, one of the lowest in the nation.

The state government has instituted policies to make the price higher than it should be while keeping the increase in value at a lower rate. One such policy that has affected the prices of housing is the policy towards lumber. Currently, lumber costs are up, and the demand is high. Mississippi currently has plenty of it to make newer houses. The problem is that production cannot keep up with the demand, and it certainly does not help when the Mississippi government places too much of a burden through regulations and bureaucratic control. Mississippi has, in the past, relaxed these regulations in order to ease the burden. It should do so again.

Perhaps the biggest factor in housing costs, however, is the need to build the Mississippi economy. The housing market is often seen as the indicator of a thriving state economy. This is because people are more willing to move into the state in which business is booming. Due to competition, if the economy is thriving and more people want to live in Mississippi, the prices will find its way to an appropriate level. In other words, if Mississippi wants cheap, quality housing, building the economy and letting the market fluctuate naturally is the best way to go.

When considering policy in this context, thinking about the big picture is often the most effective. Edmund Burke often asserts that policy change needs have a specific justification. Simply throwing things at the wall to see what sticks will bring about unforeseen consequences, ones that are often not welcome. If Mississippi sees a thriving market such as the one it sees currently in real estate, it is best to step back and let the natural benefits of the free market take hold. Increasing taxes or implementing regulations will only stifle the process and either plateau or decrease the market's progress.

You know you’ve seriously annoyed progressives when you get singled out for a hit piece in the UK’s Guardian newspaper by one of their New York-based columnists. According to Arwa Mahdawi writing in today’s Guardian, I am a “toxic politician” whom the UK was able to "successfully export."

What was it that prompted Miss Mahdawi, whom I don’t believe I have had the pleasure of meeting, to launch such a highly personal attack on a private citizen in a national newspaper? (Besides Brexit, of course).

Her tirade seems to have been prompted by the fact that I had the temerity to point out that the United States is more prosperous and innovative that Europe.

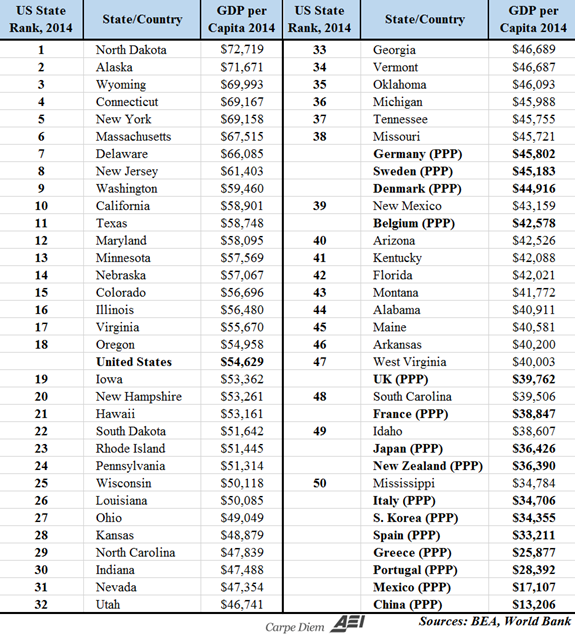

Well let’s consider the facts, for a moment. Here is a table showing how the richest countries in Europe compare the US states in terms of GDP per capita. Germany, Europe’s richest country, ranks below Oklahoma, the 38th richest state in America.

The UK is poorer that Arkansas and West Virginia. Even my own state, Mississippi, ranks above Italy and Spain. If you break the UK down by regions, Mississippi is more prosperous than much of the UK outside of London and the south east.

According to Miss Mahdawi, the US can’t be more successful because she lives in New York, where she “pays way more” for her “mobile phone plan and internet than she would for comparable services in the UK or anywhere in Europe.

Apparently the relative cost of her New York phone bill proves the Europe is better than America. Or something.

Perhaps if Guardian columnists made a little more effort to try to understand what those they write hit pieces on actually thought, they might recognize that free marketers favor more free markets.

But if they did that, then they might be forced to acknowledge that one of the reasons why certain sectors of the US economy have become cartels, without enough consumer choice and competition, is precisely because America is currently led by an administration that seeks to expand the role of government and make America more European. Much easier to make childish insults.

The interesting question to ask is why so many of Europe’s elite feel the need to lash out at anyone that suggests that the American model works better that the European.

In the UK, it is constantly implied the America’s health care system is vastly inferior. Really? Five years after diagnosis, only 56% of English cancer patients survive, compared to 65% of American patients. Poorer Americans in poor states often have healthier outcomes that many in Britain.

But again, these facts are overlooked. Anyone with the temerity to mention them gets vilified (“toxic”). And the many shortcomings in the US system are cited as evidence that nothing good ever happens stateside.

When Europe’s elites talk about America, often what they say – or won’t say – tells us more about them, than anything happening over here. The reality is that by most measures the United States gives ordinary citizens far better life chances than the European Union is able to provide for her people.

Deep down Europe’s elites know this. And they fear that their own citizens know it, too. So they constantly put America down in order to maintain their own status across the pond.

Mississippi’s regulatory code is a massive body of laws with thousands of pages and about 8.9 million words. Unsurprisingly, such a large amount of rules has immense potential to burden Mississippians, inhibit economic growth, and continually increase the size of the government.

While it can be easy to get lost in the specifics of potential reforms, one basic proposal could help to simplify the deregulation process and put the state on a path to better and better reforms. This proposal would require that for every new regulation implemented by the state government, there would have to be two regulations removed.

While this is a seemingly simple proposal, the federal government applied this rule to federal regulations in the Trump Administration starting January of 2017. In turn, the federal government saw a relatively low amount of new regulations in the Trump administration. In January of 2021, President Biden repealed the rule. Thus, although the rule is no longer in effect on the federal level, states still have the opportunity to apply the rule in a state context.

Such prior success on the federal level suggests that an effective approach to deregulation is to recognize that business regulations do not occur in a vacuum. If a company does not have to deal with one specific regulation but faces burdens and obstacles from other regulations, the company may be in just as bad a position as it was before. Thus, while incremental deregulation is effective in some circumstances, the true way to see economic prosperity from deregulation is to implement broader reforms that do not just apply to a specific line of legal code.

Furthermore, while regulatory burdens can substantially affect businesses of all sizes, it is also important to note the particular burden that a strong regulatory environment can have in the Mississippi context. With a large percentage of small businesses, the weight of even one or two additional regulations could be just enough to tip the scales against many such businesses in the state. At the same time, having a regulatory model that proactively removes burdensome regulations could spell the difference between stagnation and growth for businesses across the state.

Using a one-in-two-out model, Mississippi could see a reduction in the total amount of regulatory burdens imposed on Mississippians. While the state has been effective at repealing many of the burdensome regulations, such a policy would help place a statutory cap on the amount of regulations. This is significant so that the state does not find itself incrementally growing the regulatory burden with every passing year of lawmaking.

The legislature should continue to take the lead on removing the regulatory burden in the state. While specific repeals of certain regulations can be an effective method of cutting down red tape, broader deregulation policies could make a real difference in the Magnolia State.

If there is anything we must learn from the Great Depression and FDR’s New Deal, it is that throwing policy at a wall to see what “sticks” is never a good idea. This is especially true when those policies involve trillions of dollars.

When FDR put forth his plan to save the nation, the problem in his approach was that policy did not have an indicated, narrowly defined purpose and cost the nation greatly. Coming out of the Covid pandemic, we are facing a similar situation with Biden’s Build Back Better strategy, which would ultimately cost $3.5 trillion despite the president’s insistence that it will cost nothing. Biden believes this because his assumption is that the money will be returned when we “invest in America” in areas such as climate and providing a social safety net for families and small businesses. The irony is that some in his own party do not agree as such a bill will likely add to the already daunting inflation rate.

The reality is that virtually none of the solutions that Biden offers in this strategy is actually free. A study from the University of Pennsylvania confirms this. In fact, the national debt is said to increase by 25 percent over 30 years if Biden’s plan comes into effect.

Mississippi should not follow suit in this approach of governance. As tempting as it is just to throw money or ideas at the wall to try to fix a problem. Good policy must have a specific purpose and not operate on assumptions that “we will just make our money back.” That may be a byproduct, but it is a substantial risk that taxpayers often cannot afford if it falls through. Prudence is key.

This is why the narrative that the government is going to “invest in America” is so dangerous. For one, the government is not an investor as if it has generated its own money. The government only has money because the people have been forced to give it money. The second problem is that “investing in America” is so vague and broad that it boils down to just flowery rhetoric, yet it is treated as some profound justification for large spending. This was FDR’s strategy and it ultimately led to several lawsuits in which the Supreme Court granted relief and put back the nation several years back in recovering from the Great Depression.

Throwing money at a wall to see what sticks might help if you have unlimited resources and no consequences; however, neither President Biden nor the Mississippi government has this luxury. If effective and positive change is to occur, we must depart from this “investing in America” narrative and support the American economy by making government smaller, not bigger.

Last week’s elections in Virginia were no earthquake. Glenn Youngkin, the newly elected Republican Governor, squeaked home by the narrowest of margins. The swing from blue to red was a modest 5 percent.

Yet last week’s election could just turn out to be one of the most significant elections in America for a generation. Why?

Virginia offers the wider conservative movement a route map back towards electoral success – if (big if) they have the good sense to follow it.

It is easy when living in a state like Mississippi to assume that the Republican party is well entrenched. The reality across much of America, however, is that the conservative movement which dominated American politics when Ronald Reagan was in the White House, has suffered defeat and retreat ever since.

The last time that a Republican candidate won a popular majority in a U.S. Presidential election, for example, was back in 2004. Republican candidates have only managed to win the popular vote in two of the past nine Presidential elections.

It is not just that Republican candidates have not done so well. Even more ominously, not every Republican candidate has been …. how might I put this delicately? …. conservative.

Over the past couple of decades, states like Virginia, which at one time tended to lean conservative, appeared to have shifted decisively to the left. Until last week, that is.

Despite having failed to win a state-wide election for twelve years, last week conservative candidates in Virginia were elected not only Governor, but Lt Governor and Attorney General, too.

The Virginia result was a victory for school choice conservatism. With parents denied any real power in the public education system, moms and dads in Virginia felt anxious about some of the things their kids were being taught – such as Critical Race Theory.

Youngkin repeatedly made the issue of whether parents should be allowed a say in their child’s education the center piece in his campaign. Youngkin also calmly but firmly insisted that Critical Race Theory is wrong.

And guess what? It turns out that giving people school choice is wildly popular and that millions of ordinary Americans are not that keen on having their kids indoctrinated into believing that their country is intrinsically racists either.

Here in Mississippi, we recently published a report on Critical Race Theory in our state. It shows how conservatives might offer something similar here, too.

Perhaps the most striking thing about the Virginia result was the record support that the conservative side got from both Hispanic and African America voters. It turns out that opposing a divisive anti-American ideology has a broad appeal. Again, Magnolia conservatives should take note.

One final observation about Virginia. The conservative side in the election did something that too often conservatives are loathe to do; they tried to understand and listen to their audience before trying to persuade them.

Too many of those that work in public policy presume that arguments that excite them appeal to everyone else. They don’t. In order to win in Virginia, conservative strategists used messages and messengers that resonated with the folk they needed to win over.

Instead of school choice, they talked about school freedom. Instead of attacking obstructive teacher unions, they made it clear that they wanted a better deal for teachers – if not necessarily union bosses. It takes more than a bumper sticker to win over hearts and minds. A new conservative movement that understood this, while offering real school freedom and an alternative to critical race theory, could be unstoppable.

The individual states that make up our nation are at a crossroads. The recent wave of federal funding to states across the country has triggered questions about the extent of federal involvement and the impact of federal funding on state sovereignty and public policy.

From the specific Covid grants issued by Congress, to the bureaucratic matching system for federal programs such as Medicaid, nearly every federal dollar has something attached to it that carries the will of Washington into the states. While not all of these dollars are a precursor to bad federal policy being imposed on the states, an increasingly leftist federal government is tying more and more strings to these dollars. States need a strategy to press against such actions.

This expansion of federal control using federal money has been pushed in multiple sectors. In healthcare, the Centers for Medicare and Medicaid Services has imposed a vaccinee mandate on hospitals that receive federal funding through Medicaid and Medicare. In the education sector, the Department of Education has asserted an increasingly leftist agenda through its programs, while openly asserting on its own website that “any state that does not want to abide by a federal program's requirements can simply choose not to accept the federal funds associated with that program.”

Thus, we see that while the federal government has increasingly asserted its power over the states, much of the state sovereignty issues are ultimately questions of what dollars the state will accept. The beauty of American federalism is the ability of the states to stand against federal overreach by simply refusing federal funds or agreeing to take them only under certain terms.

Such a stance has been effective in recent months. In April 2021, the Department of Education announced its intention to prioritize the teaching of Critical Race Theory as it awarded civics and history education grants to the state education systems. In response, the state of South Dakota went so far as to directly reject all federal dollars tied to such federal civics and history grant programs. In an earlier response, 20 states had voiced their opposition and the federal government largely backed down after the pushback.

This success presents an important strategy that states can use to press against the whims of Washington. This strategy is twofold -with defensive and offensive elements. As a defense, states should not enroll or expand their involvement in any federal funding program that locks the state in and subjects it to whatever future terms the federal government may impose. On the offensive side, states should directly reject any effort by the federal government to impose damaging policies that are “sugarcoated” with optional federal dollars.

Until states collectively recognize their ability and duty to refuse funds that will impose bad policies on their citizens, the federal government will likely continue down a path of brazen overreach. Conservative state legislatures should reclaim “the power of the purse.” They should consciously reject any attempt by the federal government to wrongly manipulate public policy using the power of federal dollars. The future of these United States depends on it.