The city of Jackson has a long history of violating people’s civil liberties. For a great many years, the city’s abuses focused on your race. Now, sadly, the city’s abuses focus on your beliefs.

Last year, the Jackson City Council passed a new law that makes it a crime for those who oppose abortion inside the city limits to exercise what most of us would believe are fundamental – and constitutionally guaranteed – rights of speech and the press. The city has criminalized the conduct of its citizens through the use of nice-sounding terms like “buffer zones,” “bubble zones” and “quiet zones” around abortion centers, by creating such “zones” around all health care facilities in the city.

Here are some examples of things that will make you a criminal in the city limits of Jackson:

- Coming within eight feet of another person (even the pandemic gives us six feet!) if you want to talk or distribute printed material if you are within 100 feet of the property entrance to an abortion center;

- Congregating or demonstrating within 15 feet of the property where an abortion center is located, regardless of whether you are on public or private property.

- Playing a radio or television or the drums or using an amplifier, even on your own private property, if you are within 100 feet of the property line of a lot where an abortion center is located.

In Jackson, Mississippi today, any of those acts could get you fined $1,000 and sent to jail for 90 days. Oh, but if you work for the abortion center, you are allowed to do any of those things that are illegal for the rest of us.

These are just some of the reasons I am pleased to join Aaron Rice and the team of the Mississippi Justice Institute in representing individual citizens who have the courage literally to fight city hall. A group of ordinary citizens have brought a suit against the city on the grounds that the anti-free speech/anti-free press ordinance passed last year violates their rights under the Constitution of the State of Mississippi.

Our state constitution provides even a higher degree of protection of the free speech and press rights of Mississippians than does the First Amendment to the US Constitution for all Americans. Here in Mississippi, our constitution says that “[t]he freedom of speech and of the press shall be held sacred.”

Of course, freedom of speech and freedom of the press don’t mean very much if you can’t talk to someone or give someone what you wrote or printed. And those rights only matter anyway, right, when we say or write things the government doesn’t like. No one ever gets charged for saying or writing something the government likes to hear or read.

On the other hand, just because we have the right to free speech doesn’t mean that anyone has to listen. And no one has to read – or even take – what you write. But the government can’t make you a criminal for talking to people or giving them printed materials just because the government doesn’t like what you say, write and believe.

Before I became involved in the case, the city of Jackson had already tried to discourage its citizens from pursuing their lawsuit against the city, by procedural steps designed to increase the cost of the case and to drag it out. But all the city succeeded in doing was getting itself penalized by a federal judge for its trouble.

Now, it is time for the city finally to respond to its citizens’ claims that their rights to free speech and free press are being violated, in the face of state constitutional protection that describes those rights as “sacred.”

I look forward to being a part of their fight.

This column appeared in the Madison County Journal on August 20, 2020.

Ridgeland-based attorney Andy Taggart has joined Mississippi Justice Institute’s lawsuit against the city of Jackson’s ban on free speech around an abortion clinic.

Last October, MJI and members of Sidewalk Advocates for Life – Jackson, Mississippi launched a constitutional challenge to Jackson’s prohibition on pro-life counseling and other free speech outside the state’s only abortion facility. Taggart will now serve as pro bono co-counsel for the plaintiffs.

“Andy will be a tremendous asset in MJI’s challenge to Jackson’s unconstitutional ban on free speech,” said MJI Director, Aaron Rice. “He brings a wealth of knowledge and experience in the law and courtroom practice before our state’s highest courts.”

The new ordinance bans individuals who are near health facilities from approaching within eight feet of any person without consent, for the purpose of engaging in various forms of speech such as counseling, education, or distributing leaflets; bans people from congregating or demonstrating within 15 feet of the abortion facility, and bans any amplified sound. Violations of the ordinance could result in fines of up to $1,000 and 90 days in jail.

“I am honored to join Aaron Rice and the team of the Mississippi Justice Institute in representing individual Mississippians who have the courage literally to fight city hall,” Taggart said.

“Jackson’s ordinance bars private citizens from peacefully communicating to fellow citizens about a profound moral issue on a public sidewalk,” said Rice. “This violates well-established protections for free speech under the Mississippi Constitution, and we are confident that our clients will prevail in court.”

Taggart is a founding partner in Taggart, Rimes & Graham. He was previously a partner in the state’s largest law firm and has held an “AV” rating from Martindale-Hubbell for over twenty years. Taggart has served on numerous boards and committees, has several times been a gubernatorial appointee, and was Co-Chairman of the Mississippi Department of Corrections Task Force on Contract Review and Procurement in 2014. Taggart is highly published, including two popular books, which he co-authored: Mississippi Politics: The Struggle for Power, and Mississippi Fried Politics: Tall Tales from the Back Rooms.

“Our clients’ rights to free speech and free press are being violated, in the face of a constitutional protection that describes those rights as ‘sacred,’” Taggart added. “I look forward to being a part of the fight to vindicate their rights.”

The case is pending in Hinds County Circuit Court.

###

Some in Jackson want to ban gun shows as they look for answers to the rise in violence.

Is that a good idea?

A Jackson city councilman called for a ban on gun shows as the city deals with a rapid increase in the number of homicides.

Jackson City Councilman Aaron Banks is proposing a one-year moratorium on gun shows in Jackson. According to WAPT, Banks wants to use that time to investigate “how and if gun vendors are conducting background checks on people who buy firearms from gun shows.”

Each year, multiple gun shows are held in Jackson and attended by thousands. The next show will be held on August 29 and 30 to coincide with the state’s Second Amendment Tax Free Holiday, which allows consumers to purchase firearms, ammunition, and hunting supplies without having to pay sales tax.

If gun shows were put on hold in Jackson, they would likely only move to Pearl, Ridgeland, or other surrounding cities.

But are these gun shows to blame for Jackson’s rise in homicides? No. Studies from the federal government have repeatedly shown that less than one percent of inmates who have been incarcerated for gun crimes acquired their guns at shows. As we know, most criminals acquire their guns illegally – either through theft or the black market.

But we have heard a common refrain from gun control advocates about a “gun show loophole.” Can criminals walk into a gun show and acquire a stash of guns and ammo? Not likely. All licensed firearm dealers, which make up more than 99 percent of dealers at gun shows, are required to perform the same background check that is completed at a sporting goods store or a pawn shop.

So to answer Banks’ question, yes background checks are being conducted.

The “loophole” relates to an individual selling personal guns. This is what makes it legal to sell or gift a gun to a family member. If we wanted to close the “loophole,” we’d not only make it illegal for a father to give his gun to his daughter, but for that father to let his son use his gun on a weekend hunting trip if a background check is not completed.

While that sounds ridiculous, that is what gun control advocates are pushing when they talk about this “loophole.”

All we’d be doing is making life more difficult for law-abiding citizens without actually helping to reduce crime in Jackson, which should be our goal.

We’re happy to be part of the discussion in reducing violent crime in Jackson. We want to see licensing and regulatory burdens that make it difficult to start a career or business removed because we know meaningful work is a deterrent to crime. We’re in favor of criminal justice reforms that get nonviolent offenders out of jail, in the workforce, and home providing for their family. We agree that education needs to be improved. That is why we would love to see charter schools expanded and why we support providing parents with the ability to use their tax dollars to send their children to a private school if they are unhappy with their current situation

These are all solutions that can and would make a practical difference. Making it more difficult to legally purchase guns will earn applause from certain crowds, but won't actually solve Jackson's larger crime problems.

The Southeastern Conference recently released health and safety guidelines for the slightly postponed football season which gives schools the flexibility to determine the number of fans who are allowed to attend football games.

According to the new SEC guidelines, “Institutions shall determine the number of guests permitted to attend in accordance with applicable state and local guidelines, policies and/or regulations. In the absence of state and/or local guidelines, policies and/or regulations, Centers for Disease Control and Prevention (CDC) recommendations on physical distancing should be applied.”

Essentially, Ole Miss or Mississippi State could keep the stadium closed to fans. Or they could have limited attendance. At 25 percent capacity, between 15,000-18,000 could attend football games at each school. That naturally doubles if capacity is increased to 50 percent.

Also of interest to fans, the schools will determine what is allowable in the Junction and the Grove. According to the SEC, “Institutions shall determine whether tailgating or other large gatherings of guests (e.g., alumni events, university recruiting events, etc.) are permitted on property owned and/or controlled by the institution in accordance with applicable state and local guidelines, policies and/or regulations.”

Would tents need to be six feet apart? Or does the fact that you are likely to be six feet apart from guests of the tent right next to you count? Or do we just close tailgating? Schools will also have to determine team walks, which are not generally prone to social distancing and probably lose much of their lore with fans spaced apart.

Fans won’t have to wear a mask while sitting in 100-degree heat, assuming recommended physical distancing, but they will need it when entering, exiting, or moving throughout the stadium. Workers and athletic staff will have to wear masks at all times.

For now, Ole Miss, State, and the twelve other members of the SEC have decisions to make with major implications for the school’s revenue, the local economy, and the potential health and wellbeing of students and fans.

“In May, we had to make the tough decision to permanently close Sweet Rolls.

"After a year of trials we finally opened on December 6th. We had 24 employees and were doing pretty good. Just making it through our startup phase and excited about spring and spring break.

“Then COVID and all the mandatory requirements, hit us hard. We didn’t even get a chance to see our sweet spot for foot traffic and the stay at home orders came.

“We closed up March 15th, never to open back up. We qualified for some PPP and EIDL but the uncertainty of it all and not knowing what was next was enough for us to pull the plug. And here we are in August and we are still at 50 percent capacity in Hattiesburg.

“We were going to go under no matter what because of all this.

“It sucks, and we never got the grant funds from Mississippi. Where did that $1.4 billion go? Not to our business.”

Bobby Mitchell

Sweet Rolls

Hattiesburg, Mississippi

Wendy Swart has been a hairdresser for more than 30 years. So when she moved to Mississippi last year, she didn’t figure she would still be without a license – and without a job.

Wendy’s story began last August when her husband, Scott, landed a job in Mississippi and was preparing to move. She immediately contacted the Board of Cosmetology and was initially told her transferring should not be an issue. She would be working soon. Or so she thought.

The Board said she did not have enough hours, though she holds a teachers license that put her over Mississippi requirements. Instead, she was told she would need to take new courses, which would take time, cost money, and not pertain to the profession according to Wendy.

All to work in a profession that Wendy has devoted her career to. And never received an infraction, citation, or something similar.

There is some type of limited licensing reciprocity for cosmetologists in Mississippi, but it’s not exactly clear. Instead, Boards are devoting unnecessary time trying to compare education or training requirements across 50 states. And, as Wendy’s story shows, it doesn’t help people work, which should be our goal when qualified individuals move to Mississippi.

This is why Mississippi needs to follow the path of Arizona in adopting universal licensing for occupational licenses. In Arizona, over 1,100 individuals have applied for and been granted a license to work in fields ranging from cosmetology to engineering in just one year.

Multiple bills were introduced this year to bring such a law to the Magnolia State. The premise is if you’ve received an occupational license in another state and have a clean record, you can start working almost immediately. It’s much needed, but all bills died in committee without consideration. While Mississippi punted, Montana, Pennsylvania, Utah, Idaho, Iowa, and Missouri all followed Arizona.

A similar bill exclusively for military families has been signed into law. It has the potential to benefit many but needs to be expanded.

It should not be this difficult for someone who has 30 years of experience and has never had a knock on her record to work in Mississippi. For a state that has been on the wrong side of domestic migration over the past half-decade and during a time of economic uncertainty, we should be welcoming new residents with open arms to the state. Instead, we are putting up roadblocks.

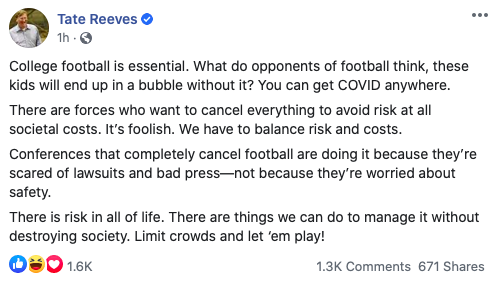

While the 2020 college football season remains in limbo with the Big 10 cancelling their season and the Pac 12 waffling, Southeastern Conference Commissioner Greg Sankey said the conference has been given the green light to continue with plans for football this fall.

And if college football does happen in Mississippi, it will do so with the support of Gov. Tate Reeves, and both SEC universities in the state: Ole Miss and Mississippi State.

Reeves took to social media today to outline his support, calling college football essential, and backed up his support during today's news conference.

“What do opponents of football think, these kids will end up in a bubble without it?" Reeves said. "You can get COVID anywhere. There are forces who want to cancel everything to avoid risk at all societal costs. It’s foolish. We have to balance risk and costs."

Along with – mostly – Republican governors like Reeves pushing for college football, we have also seen an organic campaign from student athletes. Using the hashtag “WeWantToPlay,” we have seen players, coaches, and institutions make their voice heard over a sports media empire destined to cancel college football.

You can include Ole Miss and State with that group.

There's a lot of uncertainty right now, but we know one thing...#WeWantToPlay pic.twitter.com/558QLFuJkA

— Ole Miss Football (@OleMissFB) August 10, 2020

— Mississippi State Football (@HailStateFB) August 10, 2020

Ole Miss football coach Lane Kiffin also joined in the campaign:

Our players want to play! Our staff wants to coach them! I’m so proud of our team #WeWantToPlay @OleMissFB https://t.co/LLufdtZDfi

— Lane Kiffin (@Lane_Kiffin) August 10, 2020

As did Mississippi State AD John Cohen:

Love the passion, perseverance and resilience shown by all of our student-athletes, especially during these ever-changing circumstances. We will continue fully supporting our student-athletes, coaches and staff, while keeping their health and safety our highest priority. https://t.co/gftPpP3Mnj

— John Cohen (@JohnCohenAD) August 10, 2020

The message from Mississippi's universities and political leaders? We want to play.

As the recent coronavirus pandemic has demonstrated, the healthcare system needs some rethinking and retooling. We are in great need of solutions that increase efficiency and quality while also lowering costs for providers and patients.

One such example is the problem of non-emergency medical transportation for Medicaid recipients. Millions of Americans miss their medical appointments each year. These no-shows reduce access for other patients. They also cost an estimated $150 billion a year by increasing administrative costs related to scheduling and rescheduling. In the context of Medicaid, these costs increase the price tag of Medicaid, which is a form of subsidized health insurance paid for by state and federal taxpayers.

Mississippi already offers generous transportation services for Medicaid beneficiaries, with no copay required. The amount allocated for the current Mississippi Medicaid non-emergency transport contract is $96.8 million for the period from October 2018 to September 2021. Total federal spending on non-emergency Medicaid transportation averages $3 billion a year. Could there be a way to reduce federal and state spending on non-emergency transport while also reducing the number of missed appointments?

Mississippi has used the same broker for years to facilitate Medicaid transportation, but the vast majority of Medicaid recipients are not using the service. The current arrangement may be saving some money over more traditional options, but the real question is whether mobile app technology now affords a much better and cheaper way to provide transport.

Thanks to a 2017 rule change by the Trump administration, healthcare providers are allowed to provide free or low-cost transportation services to patients. The administration is also looking at an additional rule change that would provide more flexibility in this area. An obvious solution is to use ridesharing services, like Veyo, Uber Health and Lyft, to lower costs.

Ridesharing is commonplace all across America. It works by allowing qualified drivers to use their own vehicle to transport other people. As in many other areas, the public health insurance system – Medicaid and Medicare – has yet to really catch on. But ridesharing is an innovative way of harnessing technology.

A recent study in the American Journal of Public Health estimates that adopting a ridesharing model would generate $537 million in total Medicaid savings, with an average annual savings of $268 per user. The authors also conclude that ridesharing could improve the patient experience by allowing for “on-demand scheduling, electronic records for monitoring, more-direct routes, greater reliability, and operational simplicity.”

Last year, Arizona became the first state to use ridesharing for non-emergency Medicaid transport. Multiple states have followed suit, including Florida, Georgia, Missouri, Tennessee, and Texas. A 2018 PEER report likewise recommends that the Mississippi Division of Medicaid explore ridesharing options. A conservative estimate is that Mississippi Medicaid could save millions annually from ridesharing.

At a minimum, early evidence suggests that ridesharing results in fewer missed appointments and reduced waiting times, saving money for hospitals and other providers and increasing patient satisfaction. In addition, it is less expensive than traditional transportation models and costs less per trip on average.

Another opportunity that has arisen since the 2017 Trump rule change is that nonprofit hospitals are offering no-cost transportation using ridesharing services. This service is being provided as part of each hospital’s mandated “community-benefit” requirement. Under federal and state laws, nonprofit hospitals receive billions of dollars in tax breaks in exchange for providing some kind of “community benefit,” a loophole that seems to be more of an accounting gimmick than a concrete form of help to those who most need it. Allowing ridesharing to count toward a hospital’s community-benefit activities at least provides some savings to taxpayers while affording more reliable transportation for Medicaid recipients.

Josh Komenda, the president of Veyo, observed that “there's been a huge opportunity to further develop much more modern technologies, automation, and tracking…Think about all the technologies that have been invented: cloud-based technology, mobile technology, GPS tracking, web portals, and mobile apps. These are ways that we have basically built a new management system.”

These technological innovations are revolutionizing the non-emergency medical transportation industry. For instance, legacy medical transport vendors have higher costs and less flexibility because they must maintain and house a fleet of vehicles. Ridesharing avoids this expense and can adapt more easily to spikes in unexpected demand. Ridesharing also employs the latest tracking and monitoring software in order to keep patients safe and reduce waste, fraud and abuse.

In an era of budget cuts where lawmakers are forced to prioritize services and look for more efficient ways of doing things, they should consider that other states are saving money and boosting patient satisfaction by adopting a ridesharing model for Medicaid transport. Consumer-driven and consumer-friendly technological innovations are saving taxpayers millions of dollars every year.

Why should Medicaid patients – and Mississippi taxpayers – miss out?

This column appeared in the Northside Sun.